Ultimate Guide For Health Insurance 2024

As soon as you start making money, health insurance should be your top priority, as I constantly emphasise. Medical bills have become so expensive that merely a few days in the hospital might result in bills that total several lakh rupees. I have firsthand experience with family who, as a result of not having health insurance, had health problems and incurred massive medical costs. This event serves as further evidence that all of your savings and investments could be lost with just one serious health incident.

The Financial Risks of Not Having Health Insurance

I recall a widely shared tweet by Nitin Kad that said, “Most Indians are just one hospitalisation away from bankruptcy.” In India, the startling fact is that 50% of healthcare costs are paid for out of pocket. This indicates that a large number of people are directly covering their medical costs, particularly in light of the dangerous lifestyles that many young people in their 20s and 30s are currently leading. Thus, getting health insurance ought to come first, even before making stock or mutual fund investments.

Selecting the Right Health Insurance

In this article, I want to discuss how to select the right health insurance for your family. We’ll cover three main points: first, how to identify the best insurance company; second, how to choose the best insurance plan for your family; and third, the top three health insurance plans in India.

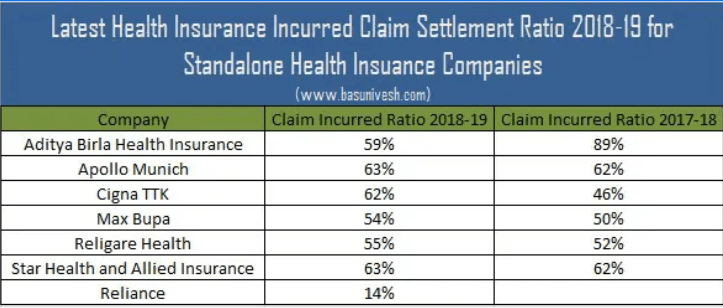

Step 1: Shortlisting Health Insurance Companies

The first step in shortlisting a health insurance plan is to assess various providers. In India, there are presently 30 health insurance companies, comprising 24 general insurance carriers and 6 independent health insurers. While general insurers offer health insurance in addition to automobile and other non-life policies, standalone health insurance businesses only offer health coverage. These five crucial factors should be taken into account when shortlisting health insurance providers because they can be confusing:

Claim Settlement Ratio

This ratio indicates the percentage of claims settled by an insurer within a specific timeframe. For instance, a claim settlement ratio of 95% means the insurance company has settled 95 out of every 100 claims filed. Ideally, you should aim for a company with a claim settlement ratio higher than 90%. You can find this data on the IRDAI website or platforms like Ditto. For example, New India Assurance has a remarkable claim settlement ratio of 99%, followed closely by HDFC Ergo at 98%, and Digit and SBI at 97%.

Hospital Network

Ensure that the health insurer has tie-ups with top hospitals in your area and major cities across India. The policy should also offer a cashless facility across its hospital network. With a cashless facility, you won’t need to pay any upfront costs. For instance, HDFC Ergo has over 11,500 hospitals in its network, Star Health has more than 14,000, and Digit offers more than 16,400.

Product Portfolio

Every individual has different requirements for health plans. Some may seek an affordable policy with minimal features, while others might need comprehensive coverage with specific waiting periods for diseases like diabetes or heart issues. Make sure the health insurer has a product that meets your specific needs.

Track Record

It’s wise to select an insurer with an established track record of several years, as this provides insights into their historical claim settlement ratio and customer service quality.

Operational Efficiency

This contains the full process, from application to claim. A smooth, hassle-free service is preferred, and private insurers typically provide higher operational efficiency than governmental insurers.Based on these factors, I recommend shortlisting insurers such as HDFC Ergo, Niva Bupa, Bajaj Allianz, Aditya Birla, and Digit, a tech-based health insurer that is performing well.

Key Features to Look For in a Health Plan

The next step is to list down key features that should be included in health insurance. I have identified nine important parameters you must check before finalizing a health plan:

Co-payment Clause

This clause requires you to pay a certain percentage of health expenses out of your pocket. For example, a co-payment clause of 20% means if your medical expense is ₹2.5 lakh, you would have to pay ₹50,000 out-of-pocket. Generally, group health insurance policies contain such clauses, so ensure that any individual health insurance you purchase does not include one.

Room Rent Capping

Ensure that your health insurance does not cap room rent or at least provides coverage for a private room with air conditioning.

Waiting Period

Each insurer has a waiting period for pre-existing diseases. For example, if you’re diabetic and seeking health coverage, you can’t expect the policy to cover diabetes-related expenses from day one. Some waiting periods can last from two to four years. If you have a pre-existing condition, choose a plan with the lowest waiting period.

Pre and Post-Hospitalization Charges

It’s crucial for your health plan to cover pre and post-hospitalization charges, including diagnostic tests that doctors often recommend before hospitalization. Look for coverage that includes expenses incurred between 30 to 60 days before and after your treatment.

Cashless Facility and Network

As mentioned earlier, ensure your health policy offers a cashless facility at major hospitals in your city and metro areas so that you don’t have to pay upfront.

Coverage of Alternative Treatments

If you require alternative treatments like homeopathy or Ayurveda, ensure your health plan includes these.

No Claim Bonus

This is a beneficial feature where some health policies offer a bonus if you don’t make any claims for a specified period. For instance, if you have a health plan covering ₹5 lakh and don’t make any claims, your coverage might increase by a specific percentage the following year, such as 20%.

Restoration Benefit

This feature is great for family floater plans. For example, if you have a family floater plan with coverage of ₹5 lakh and incur expenses of ₹4.5 lakh, you may only have ₹50,000 left for future claims. However, if you have a restoration benefit, your coverage will be restored back to ₹5 lakh, allowing you to claim again for further medical expenses.

Price

When considering health insurance, remember that cheaper isn’t always better. Don’t solely focus on low premiums; look for plans that provide decent features at reasonable rates. In short, it should be a value-for-money purchase.

Top Health Insurance Plans in India

Based on the analysis of the features discussed, I’ve selected three health insurance policies that stand out: HDFC Ergo Optima Secure, Niva Bupa Health Companion, and Aditya Birla Activ Health 1 Plus. Instead of examining them individually, I’ll compare them side by side for a clearer perspective:

- Claim Settlement Ratio: HDFC Ergo tops the chart with 98%, Niva Bupa at 90%, and Aditya Birla at 95%.

- Network Hospitals: HDFC Ergo has over 11,500 hospitals, Niva Bupa over 16,000, and Aditya Birla over 11,000.

- Co-payment provision: It is great that none of these plans include a co-payment provision.

- Again, none of these plans set limits based on a particular condition.

- Accommodation Rent: There are no ceiling restrictions on booking any accommodation with any plan.

- Aditya Birla covers 90 to 180 days, Niva Bupa covers 60 to 180 days, and HDFC Ergo covers 60 to 180 days prior to and following hospitalisation.

- Waiting Period for Pre-existing Diseases: HDFC Ergo has a waiting period of three years, Niva Bupa four years, and Aditya Birla three years. Notably, Niva Bupa offers a paid add-on that reduces this waiting period to 30 days for selected diseases such as hypertension and diabetes.

Additional Features and Options

All three plans offer a no-claim bonus. With HDFC Ergo, you receive a 50% bonus per year, up to 100%, meaning your coverage could double over time. Niva Bupa also offers a similar 50% bonus with an option for a paid add-on that can provide a 100% bonus up to 500%.

All plans provide coverage for daycare procedures and alternative treatments, as well as annual health checkups. HDFC Ergo offers one free health checkup every year, while Niva Bupa includes a paid add-on for this service. Aditya Birla also provides an annual health checkup.

In terms of restoration benefits, HDFC Ergo provides 100% restoration once per illness. If you opt for a paid add-on with Niva Bupa or Aditya Birla, you can get unlimited restoration each time a claim is made.

Lastly, while HDFC Ergo does not have an OPD feature, both Niva Bupa and Aditya Birla offer paid consultations with caps on fees.

Conclusion

This comparison of the three policies provides you with a clear understanding of your options. You can visit their websites for additional comparisons and to find the best plan tailored to your needs. Please note that the health plans mentioned here are based on the features we’ve discussed in this articles. Your choices may vary depending on specific requirements such as maternity benefits or lower waiting periods for pre-existing diseases.

In conclusion, I’d like to highlight one more valuable feature: a super top-up plan. Considering the rising healthcare costs, a health cover of ₹5 lakh may not suffice in the next 10 to 15 years, especially for critical illnesses like cancer or heart disease, which can be exceptionally costly. A super top-up plan allows you to secure an additional coverage of ₹10 to 15 lakh, increasing your total cover to ₹15 to 25 lakh. Super top-up plans are generally affordable, making them a great addition to your existing health coverage.