Understanding How Merchant Cash Advance Loans Work in Australia

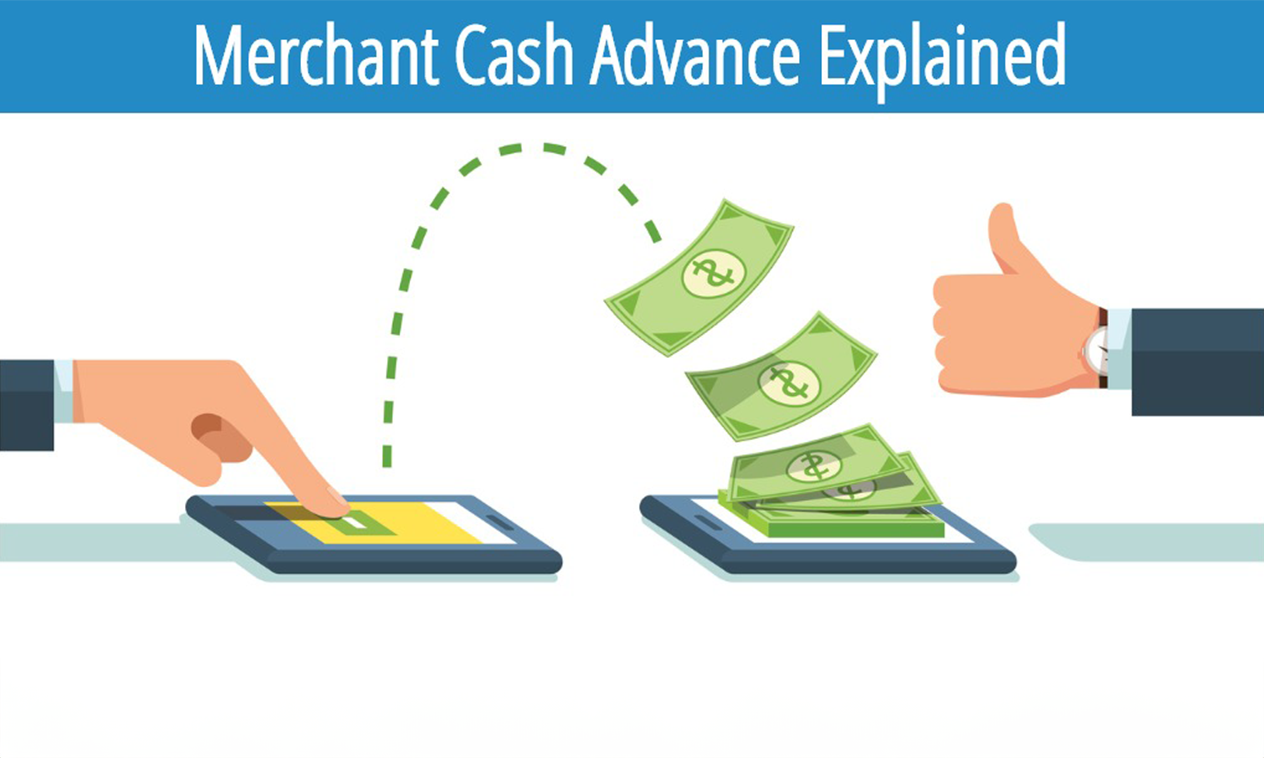

Merchant cash advance loans are an alternative type of financing option for small businesses seeking quick and accessible funds. Businesses in need of regular cash flows with high influx of credit card transactions are a good fit for this option, as payments are made regularly on a daily or weekly basis.

What Differentiates Merchant Cash Advance Loans from Traditional Loans?

MCAs are different from traditional loans as repayments are made using a percentage of your sales volume and deducted from your bank account. If sales volume is low, then the percentage withdrawn is low, and if the sales volume is high, the percentage increases, as such there is no fixed payment. Traditional loans on the other hand are fixed despite fluctuations in sales volume or not.

MCAs also use factor rates to determine the total repayment amount, unlike traditional loans that work with interest rates. These factor rates range from 1.1 to 1.5 or more.

For Example; If a particular business receives an MCA of $12,500 with a factor rate of 1.4, the business is to repay a total amount of $17,500 ($12,500 x 1.4).

Although factor rates can be quite higher than traditional loans, the edge it has is in its payment flexibility which works hand-in-hand with the business revenue per time.

Also Read: Certificate of Deposit: Definition, Advantages & How to Invest in CD

Businesses that work well with MCAs

Due to the repayment structure of MCAs, businesses with low or irregular card transactions may struggle to keep up with payments regularly. Hence, the type of businesses that suit this payment structure are ones that handle a high volume of card transactions daily like;

- Barbers shop

- Salons and Spas

- Hairdressers

- Clubs and Cafes

- Retail Stores

- Restaurants and Bars

- Service Businesses

- Logistics Companies

Why Go for a Merchant Cash Advance?

As a small business owner thinking of getting a loan, you may be wondering why a Merchant Cash Advance is a better option for your business. Here are some key benefits of MCAs that might work well with your business needs.

1. Immediate Access to funds

The time it takes to get your funds approved with an MCA is minimal when compared with traditional loans. If you are in need of urgent cash for your business, the paperwork it takes with a traditional bank loan can take forever, but with MCAs, you can get it in hours. It saves you the time and expense it would cost your business if that urgent need isn’t met.

For example, a small restaurant has an urgent need to fix a broken oven, but doesn’t have the funds to fix it, an MCA can provide the necessary capital for the oven faster than it would take you to file for a traditional loan.

2. Flexible Payment Plan

MCAs have a very flexible repayment plan, as businesses only get to pay a percentage of their daily or weekly card sales. In an instance where a retail store has a slow month, with an MCA they only pay back a smaller amount of the advance, rather than a fixed monthly payment.

3. High Approval Rate

The qualification requirements for MCAs are very lenient compared to traditional loans, making it easier for small businesses with limited credit history or a lower credit score to gain access to funds. A startup with a limited credit history can still qualify for an MCA to cover its inventory costs.

4. Opportunity for Expansion

MCAs can provide the opportunity for small businesses to have regular cash flow which they can use for marketing campaigns, expanding their product lines, hiring new staff or investing in new ideas to expand their business.

5. No Collateral

MCAs typically don’t require collateral, giving small business owners who have little or no assets the opportunity to secure a loan. For example, a service-based business in need of a small loan can use the services of an MCA without putting their personal assets as collateral.

Also Read: 7 Benefits of Managing Your Finances as a Student in Australia

The Downside to Merchant Cash Advance

While Merchant Cash Advances (MCAs) can be very viable for small businesses to secure loans, it is important to read the terms and conditions carefully before making any decision. Their ease of qualification and flexibility can be very attractive to business owners seeking quick funds. It is however necessary to note the potential downsides and ensure they don’t pose a risk to your business’s financial goals. With that said, here are some of the cons of MCAs to consider:

1. Higher Cost and Fees

Merchant Cash Advance often comes with higher interest rates than other financing options, which can lead to debt burden and can be difficult to manage.

2. Daily or Weekly Repayment Schedule

MCAs require that you remit payments directly from your credit card sales or business bank account, this can cause a strain to your cash flow and can be very challenging managing your daily operations or unexpected expenses.

3. Impact on Profit Margin

Since higher sales equate to higher payments of your daily or weekly sales, businesses may find it harder to record profit making it harder to maintain financial stability.

4. Potential for Debt Cycle

Due to their flexible payments and easy qualification, businesses tend to heavily rely on MCAs for cash flow, thereby creating a cycle of dependency. Businesses may even need to take out additional advances to cover previous debts.

| Pros of Merchant Cash Advance | Cons of Merchant Cash Advance |

| Immediate Access to Funds | Higher Cost and Fees |

| Flexible Payment Plans | Daily or Weekly Repayment Plans |

| No Collateral Required | Impact on Profit Margins |

| High Approval Rate | Potential for Debt Cycle |

| Opportunity for Expansion | Compromise your Cash flow |

Also Read: Top 7 Car Rental Companies in Australia

Application Process for a Merchant Cash Advance

1. Determine Eligibility

To be eligible for an MCA you will need to have at least been in operation for 6 months, $100,000 in yearly revenue or $10,000 in monthly revenue depending on the MCA. A minimum of 500 credit score.

2. Research Different MCAs

Research different lenders and compare their rates and terms before choosing any.

3. Documentation

After choosing an MCA, you’d need to submit an application. Depending on the lender, you may be required to submit a bank statement and other basic business information.

4. Approval Duration

After the documents have been submitted, you would receive a decision on your application which can take up to an hour or a day.

5. Review

After the application has been accepted, review and sign the contract which outlines the terms, including the payment schedule and fees.

6. Receive Funds

When the contract is signed, funds can take 3 to 5 business days to receive.

Conclusion

Merchant Cash Advance can be a valuable resource for small business owners seeking immediate funds. Their flexible mode of payment and ease of approval can be an advantage to business owners. MCAs are not without their cons, as they come with high costs and may lead to debt cycles or traps for businesses in the long run if not properly managed.

Businesses in need of funds should research different financing options and carefully review their terms before comitting. It is also important to seek professional advice where needed and evaluate your business’s financial situation to avoid potential pitfalls.

Merchant Cash Advance Terms |

Meaning |

| Advance Amount | The lump sum provided to the business |

| Payback Amount | The total amount the business must repay, including fees and interests. |

| Factor Rate | Amultiplier (usually between 1.1 and 1.5) used to calculate the payback amount |

| Holdback Percentage | A percentage usually between 10- 20% of daily credit card sales that goes towards repayment. |

| Repayment Term | The length of time to repay the advance, usually 3-12 months. |

| Origination Fee | A one-time fee charged by the provider which is usually 1-5% of the Advance amount. |

| Credit Score Requirement | Minimum credit score required to qualify, this score usually varies depending on the provider. |

| Renewal Options | Some MCAs offer renewal options, which can lead to additional fees and debt. |

| Collateral | Some MCAs may require collateral, such as assets or personal guarantee. |

| Interest Rate | The annual rate charged on the advance. |

| Default and Late Payment Terms | Consequences for missed payments or default in payments. |

FAQs

How does a merchant cash advance work?

A merchant cash advance (MCA) is a form of financing for businesses that involve the merchant receiving an upfront lump sum of cash in exchange for a percentage of their future credit card and debit card sales. The MCA provider purchases a portion of the merchant’s future receivables at a discount rate. The merchant then repays the advance and fees by allowing the MCA provider to automatically deduct a predetermined percentage from their daily or weekly credit/debit card sales until the full amount is repaid.

Key Takeaway:

MCAs provide fast access to capital for businesses but come with high fees and repayment terms tied to sales volume, so careful evaluation of costs and ability to repay from future sales is crucial before taking an MCA.

MCAs are popular for businesses with inconsistent cash flow as repayments fluctuate with sales volume. However, they can be costly due to high factor rates and have fewer regulations compared to traditional loans.

Are merchant cash advances secured?

No, merchant cash advances are generally unsecured forms of financing, which means they are not secured by any collateral or personal assets of the business owner.

When a business obtains a merchant cash advance, the lender does not require the business owner to put up any personal or business assets, such as real estate, equipment, or inventory, as collateral. The only security the lender has is the right to collect a percentage of the business’s future credit card sales or revenue.

The unsecured nature of merchant cash advances is one of the reasons why they are attractive to some business owners, especially those who may not qualify for traditional secured financing due to a lack of collateral or creditworthiness. However, it also means that the lender is taking on a higher risk, which is why merchant cash advances typically come with higher factor rates or costs compared to secured forms of financing, like bank loans or lines of credit.

Key Takeaway:

While merchant cash advances are unsecured, the lender may file a general lien or UCC (Uniform Commercial Code) blanket lien against the business assets as a way to protect their interest. This means that if the business defaults on the advance, the lender may have a claim against the business’s assets to try to recover their losses.

It’s important to note that the unsecured nature of merchant cash advances also means that the business owner does not risk losing specific assets, like a home or other personal property, as collateral if they fail to repay the advance. However, defaulting can still have serious consequences, such as damaging the business’s credit profile and ability to secure future financing.

How does a cash advance payment work?

A cash advance payment typically refers to a short-term loan that allows you to borrow money against your credit card’s available credit limit.

Here’s how it generally works:

1. Request for cash advance:

You can request a cash advance from your credit card issuer, either at an ATM, bank, or other financial institution that offers cash advance services. You’ll need to present your credit card and may need to enter a personal identification number (PIN).

2. Cash disbursement:

Once approved, you’ll receive the cash advance amount, typically up to a certain percentage of your credit card’s available credit limit. The cash advance amount is deducted from your available credit limit immediately.

3. Upfront fees:

Most credit card issuers charge a cash advance fee, which is typically a percentage of the cash advance amount (e.g., 3-5%) or a flat fee, whichever is higher. This fee is charged upfront at the time of the cash advance transaction.

4. Interest charges:

Unlike regular credit card purchases, cash advances typically start accruing interest immediately, even if you pay the balance in full each month. The interest rate for cash advances is often higher than the rate for regular purchases.

5. Grace period:

Cash advances generally do not have a grace period, meaning interest starts accruing from the day you take out the cash advance, unlike regular purchases which typically have a grace period before interest is charged.

6. Repayment:

The cash advance amount, along with any fees and interest charges, is added to your credit card balance and must be repaid according to your credit card’s terms and conditions. Minimum payments are typically required each month.

It’s important to note that cash advances should be used judiciously, as they can be costly due to the upfront fees and higher interest rates. Additionally, using a significant portion of your available credit limit can negatively impact your credit utilization ratio, which is a factor in determining your credit score.

Cash advances are generally recommended only for emergency situations or when you have no other access to funds, as the costs can quickly add up if the balance is not repaid promptly.

What is the difference between a merchant cash advance and a loan?

The main differences between a merchant cash advance (MCA) and a loan are the cost of money (MCA involves a fixed factor rate, while loans have an interest rate) and repayment structure (MCA payments vary based on daily or weekly sales, while loans have fixed, scheduled payments).

Additionally, MCAs are not regulated in the same way as loans and are often considered a high-risk, high-cost financing option.

Here are some of the key differences:

1. Nature of the financing:

- A merchant cash advance is not a loan in the traditional sense. It is a lump sum payment provided to a business upfront, in exchange for a percentage of future credit card sales or revenue.

- A loan, on the other hand, is a sum of money borrowed from a lender that must be repaid, typically with interest, over a predetermined period.

2. Repayment structure:

- With a merchant cash advance, repayment is based on a percentage of the business’s daily or weekly credit card sales or revenue. The repayment amount fluctuates based on the sales volume.

- Loans typically have a fixed repayment schedule with set periodic payments (e.g., monthly) over the loan term.

3. Interest and fees:

- Merchant cash advances do not have an interest rate in the traditional sense. Instead, they involve a factor rate, which is a multiple of the advance amount that the business agrees to repay.

- Loans typically have an annual percentage rate (APR) or interest rate that determines the cost of borrowing.

4. Eligibility criteria:

- For a merchant cash advance, eligibility is primarily based on the business’s credit card sales or revenue history, rather than traditional credit scores or collateral.

- Loan eligibility is often determined by factors such as credit scores, collateral, income, and overall financial health.

5. Repayment flexibility:

- With a merchant cash advance, repayment amounts fluctuate based on sales, providing flexibility when sales are low.

- Loan repayments are typically fixed, regardless of the business’s cash flow or sales performance.

6. Term and duration:

- Merchant cash advances are short-term financing options, typically lasting a few months to a year or two.

- Loans can have varying terms, from short-term to long-term, depending on the type of loan and lender.

While merchant cash advances can provide quicker access to funding for businesses with inconsistent or poor credit, they often come with higher overall costs compared to traditional loans. Loans, on the other hand, may have stricter eligibility requirements but may offer more favorable terms and lower overall costs, especially for businesses with good credit and consistent cash flow.

How does cash advance rate work?

A cash advance rate refers to the interest rate and fees charged by a credit card issuer when you obtain a cash advance using your credit card.

Here’s how it typically works:

1. Cash advance interest rate:

Credit card issuers usually charge a higher interest rate for cash advances compared to regular purchases. The cash advance interest rate can be several percentage points higher than the regular purchase rate, often ranging from 20% to 30% or even higher.

2. Interest accrual:

Unlike regular purchases where you may have a grace period before interest charges apply, interest on cash advances typically starts accruing immediately from the date of the cash advance transaction. There is no grace period.

3. Cash advance fee:

In addition to the higher interest rate, most credit card issuers charge a cash advance fee, which is either a flat fee or a percentage of the cash advance amount, whichever is higher. Common cash advance fees range from 3% to 5% of the transaction amount or a fixed fee of $5 to $10.

4. Calculation of interest charges:

Interest charges on a cash advance are calculated based on the average daily balance of the cash advance amount, using the applicable cash advance interest rate and the number of days in the billing cycle.

5. Repayment allocation:

When you make a payment on your credit card balance, the issuer typically applies it first to the balances with lower interest rates (such as purchases) before allocating it to higher-interest balances like cash advances. This means that cash advance balances may take longer to pay off if you’re only making minimum payments.

6. Periodic review:

Credit card issuers may periodically review and adjust their cash advance rates and fees, so it’s important to check your cardholder agreement or contact the issuer for the most up-to-date information.

It’s important to note that cash advances should be used judiciously, as they can quickly become expensive due to the higher interest rates, upfront fees, and immediate interest accrual. They are generally recommended only for emergency situations when no other sources of funds are available.

What are the risks of merchant cash advances?

The risks of merchant cash advances (MCAs) include high costs due to factor rates and associated fees, which can result in a more expensive form of financing compared to traditional loans. Additionally, the lack of regulatory oversight in the MCA industry raises concerns about transparency and potentially exposes businesses to non-standard terms and practices.

Merchant cash advances can provide a quick source of funding for businesses, but they come with lots of risks.

Here are some of the key risks associated with merchant cash advances:

1. High costs:

One of the primary risks of merchant cash advances is their high cost. Unlike traditional loans with interest rates, MCAs involve factor rates, which can effectively translate to annual percentage rates (APRs) of 30% or higher. Additionally, there may be origination fees or other hidden costs, making MCAs an expensive form of financing.

2. Inflexible repayment terms:

With MCAs, repayment is typically based on a percentage of the business’s daily or weekly credit card sales or revenue. This can be problematic for businesses with irregular or seasonal sales patterns, as they may struggle to make consistent repayments during slow periods, leading to financial strain.

3. Potential for overextending finances:

Businesses may be tempted to take on multiple merchant cash advances, committing a significant portion of their future sales to repayments. This can leave little room for operating expenses, growth investments, or unexpected financial challenges, potentially overextending the business’s finances.

4. Limited regulation:

The MCA industry is relatively unregulated compared to traditional lending, which means there may be fewer consumer protections and transparency requirements. Businesses may be vulnerable to predatory practices or unfair terms.

5. Impact on future financing:

Having outstanding merchant cash advances can make it more difficult for businesses to secure traditional financing from banks or other lenders. Lenders may view the outstanding advances as liabilities, reducing the chances of loan approval or favorable terms.

6. Potential legal issues:

In the event of default or non-payment, MCA providers may resort to aggressive collection tactics or legal action, which can damage the business’s reputation and credit standing.

7. Lack of collateral:

While MCAs are unsecured, meaning no collateral is required, this also means that the provider has limited recourse in case of default, potentially leading to more severe consequences for the business.

It’s crucial for businesses to carefully evaluate their specific circumstances, consider alternative financing options, and thoroughly understand the terms and conditions of any merchant cash advance before committing. Proper due diligence and financial planning can help mitigate the risks associated with these types of financing arrangements.

What is the factor rate of a merchant cash advance?

The factor rate of a merchant cash advance (MCA) typically ranges from 1.09 to 1.5, with higher rates corresponding to higher fees.

Also, the factor rate of a merchant cash advance is a multiplier that determines the total amount a business must repay, including the advance amount and fees.

This rate is used to calculate the total cost of the advance, which includes the principal amount and fees. The factor rate is influenced by factors such as the business’s qualification and risk profile, average monthly credit card sales, length of time in business, business industry, and personal credit history.

What is the cash advance limit?

The cash advance limit refers to the maximum amount of cash that a credit card issuer allows you to borrow against your available credit limit through a cash advance transaction.

Credit card issuers typically set a cash advance limit that is lower than the overall credit limit for purchases. This cash advance limit is usually a fixed amount or a percentage of the total credit limit, such as 20% or 30% of the total credit line. The specific cash advance limit varies among different credit card issuers and depends on factors like your credit history, income, and the type of credit card you have.

For example, if your credit card has a total credit limit of $10,000, and the cash advance limit is set at 30%, your cash advance limit would be $3,000. This means you can borrow up to $3,000 in cash against your available credit, but not more than that amount through cash advance transactions.

It’s important to note that cash advances often come with higher interest rates and upfront fees compared to regular credit card purchases. Interest on cash advances typically begins accruing immediately without a grace period. Therefore, it’s generally advisable to avoid cash advances unless absolutely necessary due to the higher costs involved.

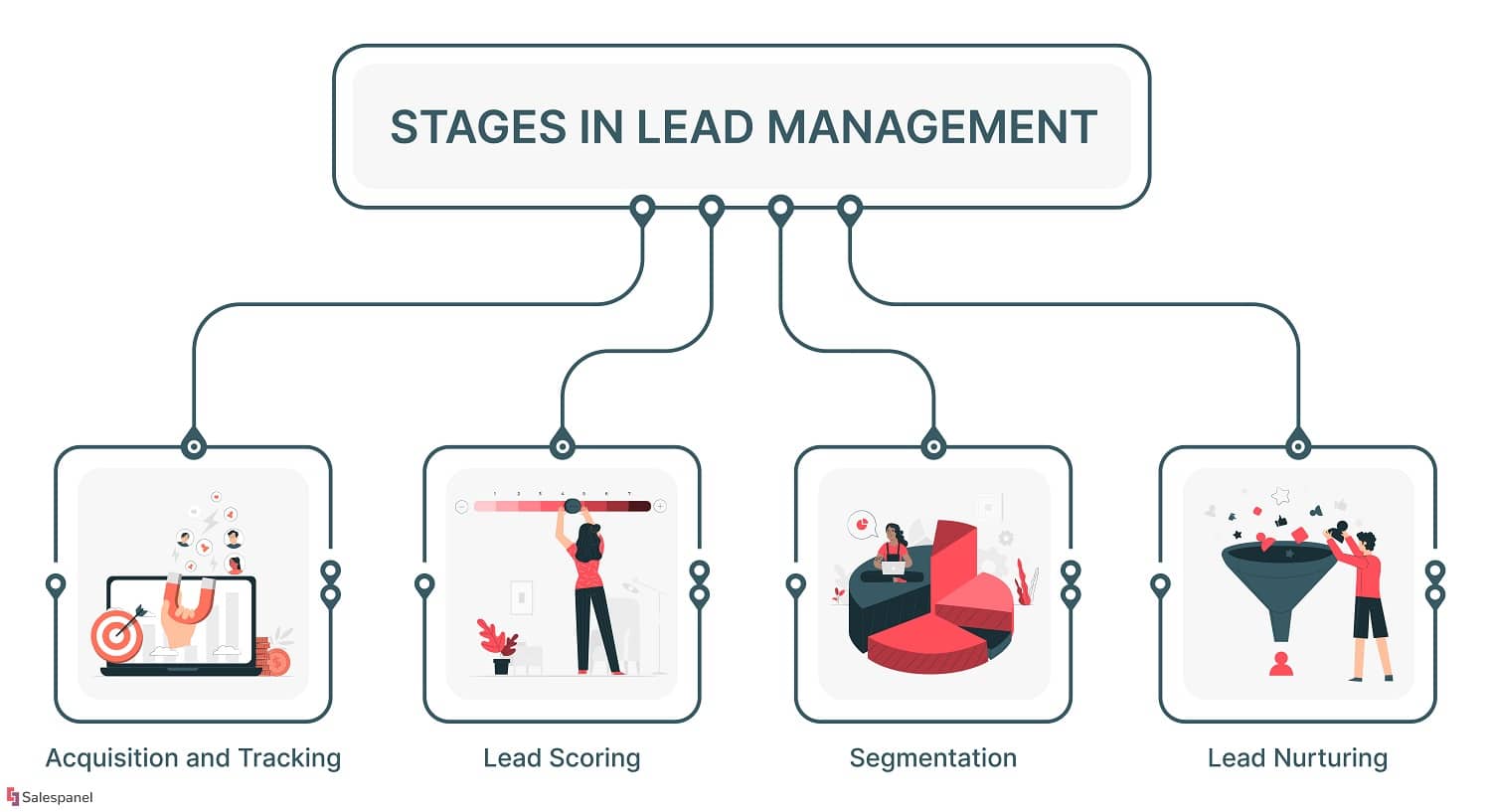

How to get MCA leads?

Here are some effective ways to generate merchant cash advance (MCA) leads for your business:

1. Attend industry events and trade shows:

Participate in local and national events where your target audience (small business owners, entrepreneurs, etc.) will be present. Set up a booth, network, and collect contact information from potential leads.

2. Partner with complementary businesses:

Collaborate with businesses that offer services or products to your target market, such as accountants, lawyers, or business consultants. They can refer clients who may need funding options like MCAs.

3. Leverage online advertising:

Use pay-per-click (PPC) advertising on platforms like Google Ads or social media platforms to target relevant keywords and demographics. Create compelling ad campaigns highlighting your MCA services.

4. Optimize your website for lead generation:

Ensure your website is optimized for search engines and has clear calls-to-action (CTAs) for visitors to request more information or apply for an MCA. Include lead capture forms and chat functionality.

5. Utilize email marketing:

Build an email list of potential leads and send regular newsletters, updates, and promotions about your MCA offerings. Nurture these leads with valuable content and special offers.

6. Leverage social media:

Be active on social media platforms like LinkedIn, Twitter, and Facebook. Share industry insights, success stories, and information about your MCA services. Engage with your target audience and respond to inquiries promptly.

7. Offer educational resources:

Provide free resources like webinars, whitepapers, or e-books that educate small business owners about alternative financing options like MCAs. Gate these resources with lead capture forms.

8. Conduct direct outreach:

Identify potential leads through business directories, chambers of commerce, or online research. Reach out to them directly through phone calls, emails, or direct mail campaigns, highlighting your MCA services.

9. Incentivize referrals:

Offer incentives or referral fees to existing clients, partners, or industry professionals who refer new leads to your MCA business.

Remember, consistency and a multi-channel approach are key to generating a steady stream of high-quality MCA leads. Additionally, ensure that your lead generation efforts comply with relevant regulations and industry best practices.

How much are MCA leads?

The cost of MCA (Merchant Cash Advance) leads ranges from $0.45 – $75 depending on the provider and the type of lead.

Here are some general price ranges:

- Exclusive Real-Time Leads: $45 per lead.

- Real-Time Online Generated Leads: $65 per lead.

- Aged Leads: $0.40 per record to $65 per lead, depending on the age of the lead and the provider.

- Exclusive real-time appointments cost $60.

- Exclusive real-time live transfers cost $75.

Please note: These prices are subject to change and may vary based on the specific requirements and needs of the business.

What are the benefits of MCA leads?

Merchant cash advance (MCA) leads offer several potential benefits for businesses seeking alternative financing options. Here are some advantages of MCA leads:

1. Quick access to capital: MCA leads represent businesses that are interested in obtaining funding quickly. MCAs can provide businesses with faster access to capital compared to traditional financing options like bank loans or lines of credit.

2. Easier qualification: Many businesses that don’t qualify for traditional financing due to factors like poor credit, lack of collateral, or limited operating history may still be eligible for an MCA. MCA leads can include businesses facing challenges that make them ineligible for other funding sources.

3. Flexible repayment: Repayment for an MCA is typically based on a percentage of the business’s future sales or revenue. This can be more manageable for businesses with fluctuating or seasonal sales patterns, as repayment amounts adjust based on their cash flow.

4. No collateral required: MCA leads represent businesses interested in financing that doesn’t require putting up collateral, which can be beneficial for those without significant assets or those averse to risking their personal or business assets.

5. Opportunity for high-risk businesses: Businesses considered high-risk by traditional lenders, such as those in volatile industries or with inconsistent cash flow, may find MCAs more accessible through the leads generated.

While MCA leads can be valuable for businesses seeking alternative financing, it’s important to carefully evaluate the specific terms, costs, and repayment structures associated with each opportunity to ensure it aligns with your business’s needs and goals.

How to sell MCA?

To sell a merchant cash advance (MCA), identify potential buyers, prepare the portfolio, list it on a platform, communicate with buyers, and close the sale by signing a contract and receiving payment directly from the buyer.

To sell a merchant cash advance (MCA), follow these steps:

Understand the MCA Market:

Familiarize yourself with the MCA market, including the product, its benefits, and the target audience. This will help you tailor your sales approach to effectively communicate the value of the MCA to potential buyers.

Identify Potential Buyers:

Identify potential buyers who are interested in purchasing MCAs. This can include debt buyers, collection agencies, legal companies, family offices, and funds.

Prepare the Portfolio:

Prepare the MCA portfolio by organizing it into pools and ensuring all necessary documents are in order. This includes the Seller’s Questionnaire, which provides detailed information about the portfolio to potential buyers.

List the Portfolio:

List the portfolio on a platform like Debexpert, which allows you to auction the portfolio to multiple buyers. This ensures you receive the best possible price for your MCA.

Communicate with Buyers:

Use the platform to communicate directly with potential buyers, answering their questions and addressing any concerns they may have. This helps build trust and ensures a smooth sales process.

:max_bytes(150000):strip_icc()/GettyImages-1450376676-b9c9e8ab26834c33bd368eaecb103558.jpg)