Explore 5 Key Stock Market Strategies: From Value Investing to Day Trading.

Introduction: Ways to Invest in the Stock Market

So, what are the ways to invest in the stock market? In this article, I’m going to go over five different ways on how to invest or trade in the stock market.

Hey, how’s it going? On this channel, we talk about stocks and options with the idea of allowing you to maintain a full-time job or trade as a full-time job. So if you’re new here, consider subscribing. Today we’re talking about basic stock market investment strategies.

There are infinite ways to trade, invest, and make money in the stock market, but there are a few major time frames to really focus on when trading. What I mean by that is:

1. Value Investing

Value investing involves buying a stock and holding it with the idea of keeping it for five or more years, maybe even forever. This is the Warren Buffett strategy—stocks will always go up over time, especially if you pick a good one.

An example of that right now could be Amazon. I don’t really see Amazon ever doing poorly in the long run; it’s just growing and growing. That could be an example of a value investment.

2. Long-Term Investment Strategy

The long-term investment strategy is based on the outlook of a company for the next one to five years. It’s a strong outlook, but beyond that, it might not be profitable, like a fad. For example, if I thought Snapchat might be around for a while, I might invest in it for a few years. However, I don’t believe it’s something like Amazon, which I think will be around forever.

As I saw Snapchat start to dwindle and maybe not look as profitable, I would move my money elsewhere to a better-looking investment. Usually, with these two strategies, it’s generally based on the fundamentals of the company—how the cash flow and balance sheets are doing—rather than stock price or chart movements.

3. Medium-Term Investment

A medium-term investor holds stocks anywhere from a few months to almost a year. This approach could be based on either stock charts, price action, or the fundamentals of a company. If you think the company will produce good financial results over the next year and the stock price will increase, it can be a profitable investment.

4. Short-Term Trading

Short-term trading spans one to three days and is generally based on stock charts or price action. You can’t really predict what a company is going to do in such a short period based on financials. Short-term price action is influenced by investor sentiment, news articles, and how people feel about buying or selling a stock.

For instance, a company might be doing really well financially, but if investors panic due to news, it can cause the stock price to drop. The financial performance of a company takes longer to impact the stock price.

5. Day Trading

Day traders buy and sell stocks throughout the day. They don’t hold stocks long-term but aim to catch small price movements to make quick profits. Day traders may do this all day or just for a few hours each day.

A big difference between short-term traders and value investors is that value investors generally buy stocks and hold shares in a company. On the other hand, short-term or day traders often use different assets like options, stocks, or futures.

Stock Portfolios and Diversification

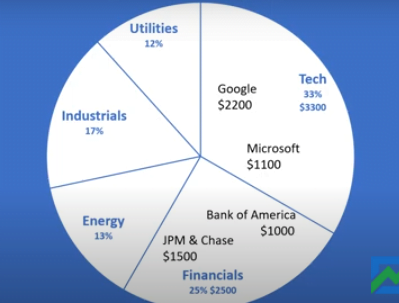

One of the most common ways to invest long-term in the stock market is through stock portfolios. The idea behind a portfolio is to spread your money across different companies and sectors, reducing your risk.

For example, if you have $10,000 to invest, you might allocate 33% to tech companies like Google or Microsoft. This diversification helps protect your portfolio—if the tech sector crashes, only part of your portfolio will be affected.

Typically, when one part of the market is doing poorly, another part is doing well. For instance, if the tech sector is underperforming, financials might be thriving. You might allocate 25% of your portfolio to financial stocks like Bank of America or JPMorgan Chase. Other sectors include industrials, utilities, and energy.

This strategy of diversification can involve holding anywhere from ten to a hundred stocks, or even more, in one portfolio.

Pre-Built Portfolios: Mutual Funds

When I first started, selecting 20 or more different equities to build a broad portfolio seems intimidating. Thankfully, there are pre-built portfolios, sometimes known as mutual funds. Mutual funds are classified into several sorts, with some seeking aggressive returns and others aiming for certain retirement dates.

Index Funds

Index funds are another option, as they track stock market indices like the S&P 500. Instead of picking individual stocks, index funds disperse your money in the same proportion as the index. For example, if Google makes up 1% of the S&P 500, an index fund will allocate 1% of your investment to it.

The benefit of index funds is that they produce the same returns as the stock market. Unlike mutual funds, which might vary in performance, index funds generally reflect the market.

Fees and Costs

Both mutual funds and index funds come with fees. Mutual funds tend to have higher fees than index funds because they are actively managed. Even small fees can add up over time, especially if you hold a fund for 10, 20, or 30 years. However, low-fee options are becoming more common. Vanguard is an excellent place to find low-cost mutual or index funds.

Short-Term Trading Strategies

Shorter-term strategies can seem more complex because there are so many ways to make money in the stock market. For shorter timeframes, investors may use options, futures, or Forex. You don’t need to understand these fully now, but they are other ways to trade financial assets in the stock market.

For shorter timeframes, you need a good understanding of fundamentals or stock charts. Unlike long-term strategies where you need a diversified portfolio, short-term traders can make money by focusing on one or two strong stocks they believe will perform well.

Conclusion

Finally, you don’t have to follow the traditional way of building a stock portfolio or purchasing a mutual fund. You can learn to trade or invest in the stock market and employ various techniques to generate long- or short-term profits.

Thank you for reading the entire article. If you want to learn more about stock trading or stock selecting, be sure to subscribe. I’ll be releasing additional articles on how to interpret stock charts and make educated predictions about where a stock will go. If you have any queries, please leave them in the comments below. See you next time!