Crafting a Personalized Mutual Fund Strategy: My Journey and Insights

Understanding My Mutual Fund Investments: A Personal Approach

What are my mutual fund investments, how I chose them, and how you can develop a mutual fund strategy based on your age and income. In this article, I discuss my investment choices, and you can also check out my articles on the same topic linked in the comments and description. A lot of people asked me to share the mutual funds I use so they can choose the same.

Why You Shouldn’t Simply Copy My Investments

First of all, it’s foolish to use someone else’s mutual fund strategy. What works for me may not work for you. My risk-taking capacity, money needs, and financial goals are different from yours. Personal finance is, after all, personal. So, even though I mention specific funds in this article, this is not financial advice. I’m not being paid to mention these funds, and it’s important to note that you should do your own research before making any investment decision.

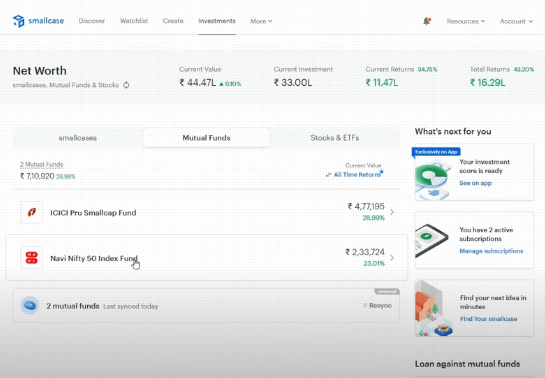

Mutual Funds I Have Invested In

Let me start by showing you the mutual funds and small cases I’ve invested in.

AK’s Small Cap Fund

Small cap funds are particularly interesting to me as a long-term investor. I’m not looking to withdraw money for at least 5 to 10 years. The XIRR (Extended Internal Rate of Return) here is quite impressive, with an annual return of about 31.99%. Keep in mind that the current market is on an upward trend, which affects these figures. My profit and loss currently stand at 20%, but this may fluctuate.

ADAC Small Cap Fund

The returns on this fund are unrealistically high right now, at around 40.6%. Over the long term, I expect it to settle around 18-20%, which is typical for small caps. While small caps have performed well in the past couple of years, I predict a major correction within the next 1-2 years.

Parag Pareek Flexi Cap Fund

This fund is known for its global and Indian investments. The XIRR here is 20.9%, and while this might seem low, it reflects a reduced risk level, making it a more balanced investment. Over a 10-year period, a 20% return can give you approximately 16 times your investment.

ICICI Prudential Small Cap Fund

Another small cap fund I invest in. While the XIRR isn’t displayed, a 1-year return of 46.5% and a 5-year return of around 30% show significant growth, though these numbers are quite aggressive.

Navi Nifty 50

This fund invests in India’s top 50 companies, making it a relatively safe and low-expense option. The expense ratio for this fund is much lower compared to small caps, which tend to have higher management fees.

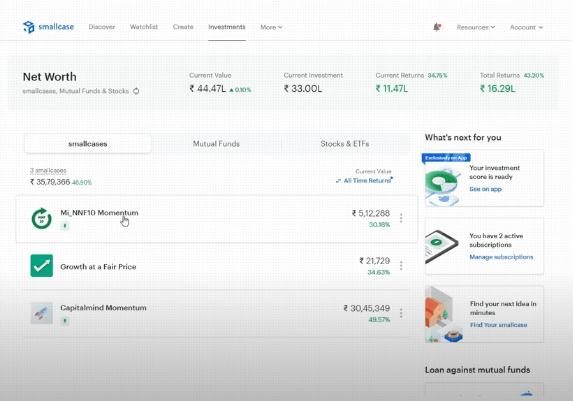

Small Case Investments

In addition to mutual funds, I also invest in small cases, particularly those following a momentum strategy.

MI AF A NF10 and Capitalmind Momentum Strategy

These funds invest in stocks that show price momentum, meaning that stocks growing in value are expected to continue growing for a short period. It’s a very active investment strategy, with changes happening weekly. The XIRR for these funds is around 28%, which I’ve been quite happy with.

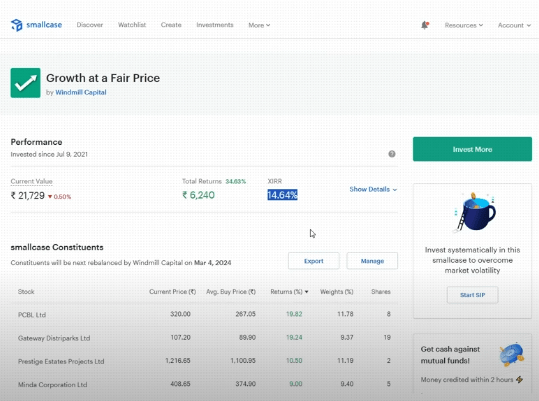

Growth at a Fair Price

This small case has an XIRR of 14.6%, which is fairly reasonable for a balanced portfolio. I’ve been invested in it for about two and a half years, and it has returned 145%. The stock prices here are relatively low, which allows me to test certain investment strategies.

Why I Don’t Pick Stocks Individually

I don’t typically pick individual stocks because I’m not an expert in stock picking. The few times I have, they’ve been in sectors where I have some knowledge, like the pharmaceutical industry. Most of my investments are through mutual funds, small cases, or portfolio management services (PMS).

My Criteria for Picking Mutual Funds

I use three main considerations when picking mutual funds:

Long-term Returns

I look at the returns over a long period—3, 5, and 10 years if available. This gives me confidence that the fund can deliver consistently.

Assets Under Management (AUM)

I prefer funds with an AUM between ₹2,000 and ₹25,000 crores. Too much or too little in AUM can cause price fluctuations, especially in small cap funds, where the market cap is smaller.

Expense Ratio

The expense ratio measures how much it costs to buy a mutual fund. It’s expressed as a percentage, usually ranging from 0.5% to 1.5%. I also avoid funds with high exit loads, which are penalties for selling your investment early. For example, I am willing to take a 1-year exit load, but no more, as I’m a long-term investor.

Building a Mutual Fund Strategy Based on Your Age and Income

Now let’s discuss how you can build your mutual fund strategy based on your age and income. There are three age brackets: 20s, 30s, and 40s, and three income levels: under ₹3 lakhs, ₹3-9 lakhs, and over ₹9 lakhs.

In Your 20s

If you’re in your 20s, your focus should be on equities. Here’s a breakdown of how to allocate your investments based on your income:

- Income < ₹3 Lakhs: Invest 75% in equity, with 65% in Nifty 50, 10% in mid cap, and 0% in small cap.

- Income ₹3-9 Lakhs: Invest 75% in equity, but increase your mid cap exposure to 30%, with 45% in Nifty 50 and 30% in mid cap.

- Income > ₹9 Lakhs: You can afford more risk, so invest 80% in equity, with 35% in small cap, 40% in mid cap, and 25% in Nifty 50.

In Your 30s

As you age, the need to take risks decreases, especially as responsibilities increase.

- Income < ₹3 Lakhs: Allocate 70% to equity, with 50% in Nifty 50, 20% in mid cap, and 0% in small cap.

- Income ₹3-9 Lakhs: Invest 75% in equity, with 60% in Nifty 50, 30% in mid cap, and 10% in small cap.

- Income > ₹9 Lakhs: You’re still in a good spot to take on some risk. Invest 75% in equity, with 50% in Nifty 50, 35% in mid cap, and 15% in small cap.

In Your 40s

Many people think it’s too late to invest in their 40s, but this isn’t true. You still have 15-20 years before retirement.

- Income < ₹3 Lakhs: Focus on stability. Invest 50% in equity, with 80% in Nifty 50 and 20% in mid cap.

- Income ₹3-9 Lakhs: Invest 60% in equity, with 75% in Nifty 50 and 25% in mid cap.

- Income > ₹9 Lakhs: You can still invest 70% in equity, with 70% in Nifty 50 and 30% in mid cap.

Conclusion

The mutual funds I’ve mentioned are not recommendations but rather my own investments based on personal criteria. I hope this article gives you a sense of how to create your mutual fund strategy based on your age and income. Always remember that personal finance is deeply personal, so make sure to do your research and pick investments that suit your own financial goals.

FAQs: My Experience and Learnings for Formulating a Customised Mutual Fund Strategy

1. What is a fund that is mutual?

An investing tool called a mutual fund collects money from multiple investors to purchase a variety of stocks, bonds, and other securities. It makes it possible for individual investors to gain exposure to a wide range of assets managed by professionals.

2. Is it not better to just adopt the mutual fund approach of another person?

Investment strategies ought to be customised for each individual based on their financial objectives, risk tolerance, and circumstances. Because everyone is different in terms of age, income, and personal financial situations, what works for one person might not be suitable for another.

3. What is the best way to select mutual funds?

Think on things like the fee ratio, assets under management (AUM), and long-term results when choosing mutual funds. It’s critical to carry out independent research and match your decisions to your financial objectives.

4. Which age groups ought to concentrate on stocks?

While investors in their 30s and 40s should gradually move towards a more stable and balanced portfolio, younger investors in their 20s can usually afford to take more risks with a higher allocation to equities.

5. How important is a long-term plan for investing?

A long-term investing plan takes advantage of compound growth potential and helps to weather market swings. Over time, it enables you to match your investments to your financial objectives.