How To Manage And Invest Your Money Wisely: A Step-by-Step Guide

This article is for you if you’re having trouble figuring out how to manage your finances. We’ll go right into what you can do to improve the way you handle your finances.

Getting a handle on our money is crucial because we’ll deal with money throughout our lives. The better we manage it now, the better we’ll be later on. I’ll cover the steps we should follow to handle money as wisely as possible, and I’ll share the steps I use to manage my own money.

Money Mindset

Our financial thinking needs to be addressed first. Even though you might not think of it as being that significant, it is. We need to develop an abundance mindset instead of a scarcity mindset because it can substantially effect our finances. That’s precisely what will happen if we believe we’ll always be broke, live pay cheque to pay cheque, or never have extra money. But if we switch to an abundance mindset and start thinking, “I can have extra money this month, put some in my emergency fund, and pay all my bills while having some left over,” then that will become our reality.

You must believe that there’s plenty of money to go around. Making more money doesn’t mean someone else has to make less. Be clear on your mindset—know that you can build wealth, make more money, and let go of any past financial mistakes. Forgive yourself and focus on making improvements moving forward.

Track Income and Expenses

The second part of handling money wisely is knowing what’s coming in and going out. One way I do this is by using a free app called Personal Capital. You can link all your financial accounts to it, allowing you to view your full financial picture in one place. This way, you don’t have to write down every expense or track every swipe of your credit card. Personal Capital automatically populates your spending and income so you can see everything in one place.

If you’re interested, I’ll leave a referral link in the description. If not, make sure you’re tracking your finances with a spreadsheet, Google sheet, or even by writing them down so you know exactly what’s coming in and what’s going out.After we’ve got a clear view, we can concentrate on cutting our three biggest costs. These will have the most influence. For instance, it is more efficient to save $500 on rent each month as opposed to $10 off your internet cost. Set those higher costs as a top priority to see results more quickly.

Seeing everything we spend also helps ensure we pay our bills on time and avoid extra fees or interest. This way, we can put more money toward an emergency fund, paying off debt, or investing instead of wasting it on late fees.

Allocating Income

When you receive money, make sure to allocate it where it needs to go. I like to pay my tithing and myself first. Having a giving attitude and paying yourself first is important. By “paying yourself,” I mean allocating money to an emergency fund. If you don’t have one, set it up immediately. Once you’ve established your emergency fund, you can work on paying off high-interest debt—anything over 8%.

Make a payment plan for each debt you have. If you need more information. After setting up your emergency fund and addressing your high-interest debt, you can start thinking about the long-term by investing your money.

Investing for the Future

You have various investment options. You can invest in education to build skills that can help you make more money, in real estate (which I cover in my real estate playlist), in the stock market (which I also do), or in your own business or someone else’s. Depending on where you are in your financial journey, you may need to invest in education to increase your income and provide funds for other investments.

Embracing Financial Discipline

Here’s a step that many people overlook: Enjoy having money without feeling the need to spend it. In today’s culture of rapid gratification, many consumers feel compelled to make purchases right away. But ultimately, the majority of these purchases are either thrown away or discarded. Let rid of the desire for rapid gratification and put your attention on the long term. If we can learn to enjoy having money, we’ll live wealthier lives.

When we have extra money, instead of rushing to spend it, we should let it sit in our accounts until a great investment opportunity comes up or an emergency happens. Embrace the feeling of having money rather than spending it.

Using Credit Wisely

A crucial element of financial management is the appropriate use of credit. In order to make greater purchases for less money and take advantage of low interest rates offered by credit, we must raise our credit score. This procedure is facilitated with a high credit score. To prevent incurring interest, open credit cards and use them sensibly, making sure to pay them off in full each month.

Setting Financial Goals

Setting financial goals is crucial to avoid living paycheck to paycheck. Be specific and set fun, exciting financial goals. Having goals changes how you handle money. For instance, if you’re saving for a trip to Italy, you might choose to eat at home rather than dine out, putting that money toward your trip fund. One good habit often leads to another, so focusing on financial goals can help you in other areas of life as well.

When setting goals, make sure you have a plan to achieve them. Think about the traits of someone who has achieved the goal you’re aiming for and model their behavior. For example, if you want to be a millionaire by 40, consider how a millionaire would handle their money.

How I Handle My Money

As promised, here’s a breakdown of how I handle my money. When I receive money, I pay my tithing first and then myself. This means I ensure my emergency fund is fully funded. I keep my emergency fund in a separate high-interest account with Ally, which offers a competitive interest rate. Since that money is just sitting in savings, I want it to earn as much as possible.

I also have all my bills on autopay but track my checking account closely. Each month, I update a checkbook register I created in Google Sheets to see exactly how much money will be in my account once my bills are paid. I keep a small buffer in my checking account and transfer any extra funds to my Ally savings account. Ally has a feature called “buckets,” where you can allocate savings for specific goals like a trip or an emergency fund.

When I have extra savings, I transfer it to my brokerage account or Roth IRA to invest. One of my bills includes an automatic transfer to Vanguard, where I purchase my favorite index fund each month. This helps me dollar-cost average by buying consistently regardless of market highs or lows.

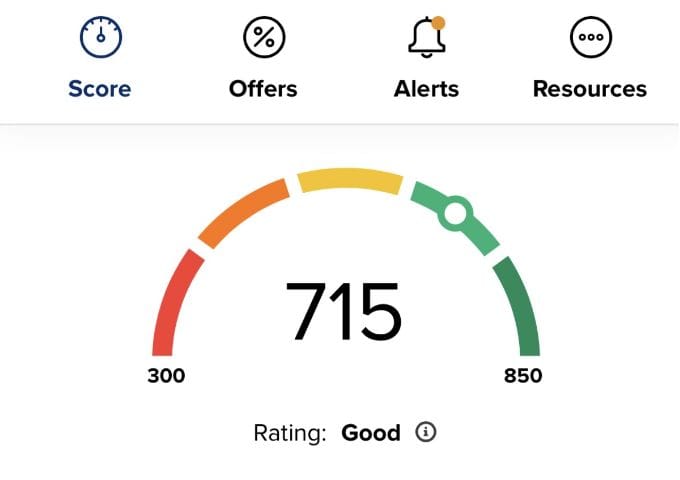

Credit Score and Money Monitoring

I also keep an eye on my credit score, especially if I plan to buy another house. I use Credit Karma for this, a free app that provides an estimated credit score and alerts when credit cards are paid off or debt disappears. I’ll leave a referral link in the description.

I also check Personal Capital daily to monitor my accounts. For example, I once caught a subscription charge I had already canceled and was able to get it refunded before it even showed up on my credit card statement.