Illegal Bitcoin ATMs and How to Spot Them: All You Need to Know

With the use of cash or debit cards, users can purchase or trade cryptocurrencies like Bitcoin at Bitcoin ATMs, or BTMs. Though they are made especially for bitcoin transactions, these devices function similarly to conventional ATMs.

Because they are simple to use and convenient, people may avoid the typical internet transactions, which has led to their rise in popularity. Bitcoin ATMs are widely available in public locations such as shopping centers, petrol stations, and convenience stores. They offer a quick and easy method of converting fiat money into digital assets.

When a user uses a Bitcoin ATM, they must first insert cash into the device, which causes an equal amount of Bitcoin to be transferred to their wallet. These devices occasionally let users to sell their Bitcoins in order to withdraw cash.

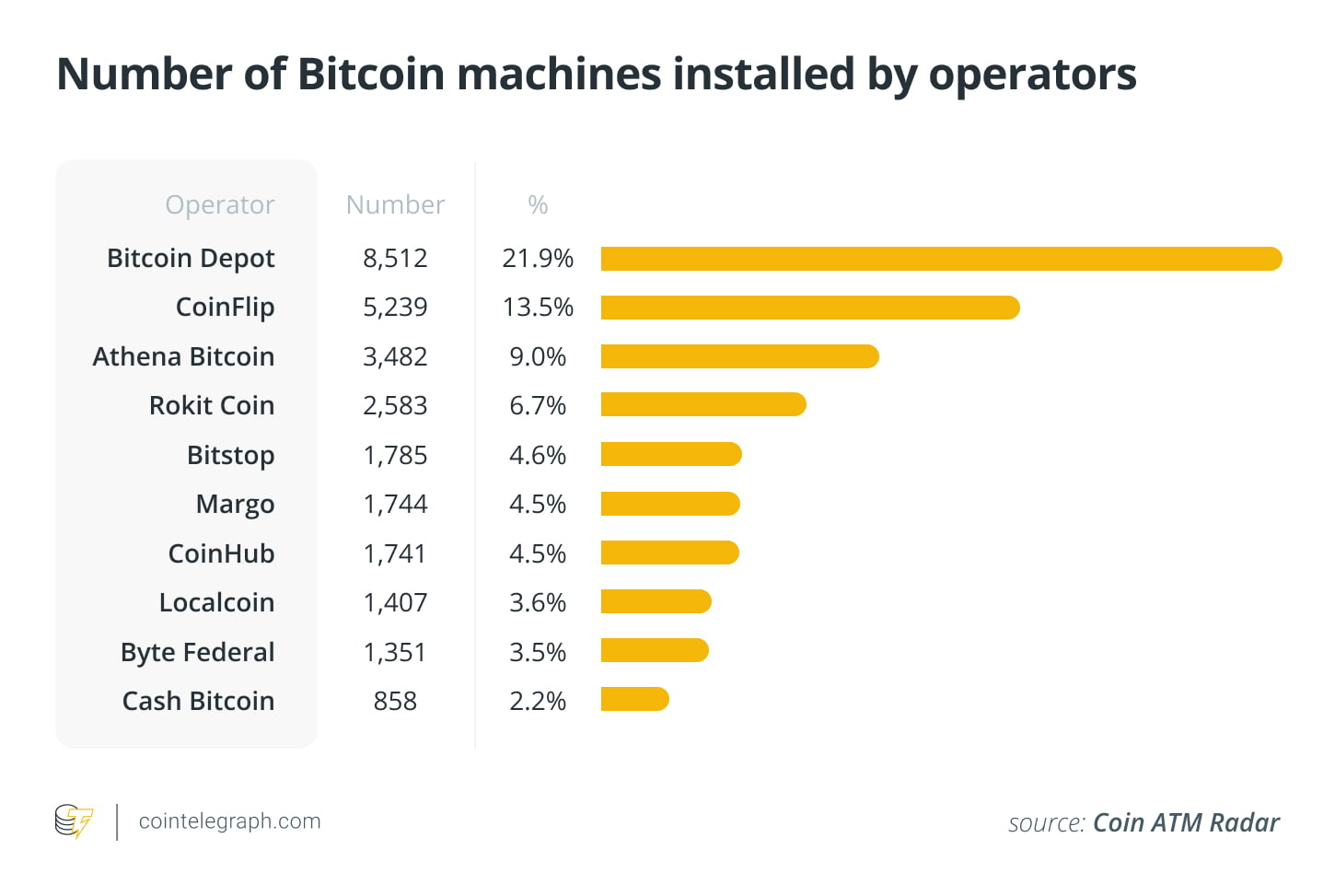

Bitcoin ATMs are quick and easy to use, although they frequently charge more than online trades. In spite of this, the expanding global number of machines is indicative of the growing demand for them among aficionados for cryptocurrencies.

For people who want to conduct fast transactions without having to deal with complicated web trades, these ATMs are essential. But not all Bitcoin ATMs are compliant with the law, which contributes to the expanding problem of illicit devices.

Understanding Bitcoin ATMs

The purpose of Bitcoin ATMs is to make it easier to transact using Bitcoin and real money. There are typically two types of machines: one-way and two-way.

A two-way Bitcoin ATM lets users buy and sell the cryptocurrency, whereas a one-way ATM simply allows consumers to buy it.

The blockchain technology, which safely and transparently verifies and processes the transactions, is the essential element.

Users often need to have a digital wallet available in order to utilize a Bitcoin ATM. The device completes the transaction by scanning a QR code from the user’s wallet once they input the amount of money they want to swap.

In return, Bitcoin is sent to the user’s wallet, or in the case of selling Bitcoin, cash is dispensed. It’s a straightforward process but can be a bit overwhelming for those new to cryptocurrencies.

Bitcoin ATMs provide a bridge for those who prefer to handle physical cash rather than deal solely with digital platforms. However, the unregulated nature of the cryptocurrency market has opened the door for illegal Bitcoin ATMs that operate outside the law, posing serious risks to users.

Understanding Illegal ATMs

Illegal Bitcoin ATMs operate outside of financial regulations and often bypass the legal standards set by governments and authorities. These machines do not adhere to the Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations that are required to protect consumers and track illicit activity. Legitimate Bitcoin ATMs follow strict guidelines, including verifying users’ identities, keeping transaction records, and reporting large transactions to regulatory bodies.

Illegal ATMs, on the other hand, are a popular option for criminals wishing to commit fraud or launder money because they avoid these regulations. These devices are very alluring to people looking for financial anonymity because there is no oversight, which is especially troubling in light of the surge in cybercrimes and illicit cryptocurrency trading.

The fact that illicit ATMs are frequently concealed in plain sight, found in public places, and blend in with real ATMs makes them even more dangerous.

Although there’s no reason to be suspicious right away, these ATMs might be a part of a bigger illegal network. Illicit acts can remain undetected because it is impossible to track transactions in the absence of appropriate regulation.

How Scammers Use Illegal Bitcoin ATMs to Defraud Investors

Scammers have found creative ways to exploit illegal Bitcoin ATMs, often targeting vulnerable or inexperienced investors. One common scheme involves scammers convincing individuals to use Bitcoin ATMs to send funds under false pretenses, such as pretending to be a government agency or tech support.

The scammers provide a QR code, instructing the victim to send Bitcoin through the ATM, after which the money is nearly impossible to recover.

Another tactic involves fraudulent investment opportunities. Scammers lure investors by promising high returns in cryptocurrency and instruct them to deposit money through an illegal Bitcoin ATM. Once the funds are transferred, the scammers disappear, leaving the victim with nothing. The anonymity and lack of regulation around illegal ATMs make these schemes hard to trace and shut down.

The use of illegal Bitcoin ATMs by scammers poses a significant threat to anyone unfamiliar with how legitimate transactions should work.

These machines enable criminals to move funds quickly, often across borders, without leaving a trace. As more people use Bitcoin, the methods scammers use to exploit these machines continue to evolve.

How to Spot Illegal Bitcoin ATMs

Spotting an illegal Bitcoin ATM requires vigilance and understanding of how legitimate ATMs operate. One of the first signs of an illegal machine is a lack of transparency in the transaction process.

Legal Bitcoin ATMs require users to provide some form of identification and follow KYC procedures, such as verifying a phone number or scanning an ID. If the machine does not ask for these, it may be operating illegally.

Another red flag is the location of the ATM. Legitimate machines are often found in reputable public areas like banks, airports, or large retail stores.

If you encounter a Bitcoin ATM in a less reputable location, such as a sketchy shop or a poorly lit area, it’s worth investigating further. Always check if the machine’s operator is registered with local financial authorities, which can often be verified online.

Additionally, illegal ATMs may charge exorbitantly high fees compared to regulated machines. If you notice unusually high transaction fees or suspicious terms of service, it could indicate that the ATM is not compliant with regulations. Always be cautious when using these machines and prioritize safety over convenience.

It may be tricky to spot an illegal Bitcoin ATM, but there are a number of warning bells, including:

- Lack of licensing: Before using a Bitcoin ATM, it’s a good idea to check it on sites such as CoinATMRadar and LocalCoinATM. If you can’t find any information about the ATM operator or its legitimacy, it’s safer to avoid using that machine.

- Locations: Illegal Bitcoin ATMs are located in back alleys or convenience stores with low supervision. Of course, not all ATMs in low-end locations are illegal, but the placement of a machine can be a warning sign.

- No KYC: Legitimate Bitcoin ATMs are legally required to implement a KYC process. It means that you need to verify your identity to be able to transact. If an ATM lacks the KYC process, it’s a sign it might be functioning illegally.

- Excessive fees: Illegal machines are likely to charge high fees. Depending on the ATM you use and its location, you may need to pay between 4% and 25% of the value of your transaction. If the fee is unusually high, it may indicate that the ATM is not legal.

- Poor maintenance: Illegal Bitcoin ATMs are not usually properly maintained. Moreover, they are not associated with a regular Bitcoin ATM operator such as Bitcoin Depot or CoinFlip. Just a generic box with no branding elements, such as logo or operator information, should be a red flag.

Risks of Illegal Bitcoin ATMs

The risks of using illegal Bitcoin ATMs go beyond just financial losses. Users who unknowingly engage with these machines could be participating in money laundering schemes, potentially facing legal consequences. These machines also put personal information at risk.

Illegal ATMs do not follow data protection protocols, making it easier for scammers to steal sensitive information like digital wallet addresses, phone numbers, and identification.

Using an illegal ATM also exposes users to security vulnerabilities. Without proper regulation, the machines may have malware or other malicious software that compromises the transaction, resulting in stolen funds or hacked wallets.

The anonymous nature of these ATMs makes it difficult to track where your money is going, which is a massive risk if something goes wrong.

Lastly, there’s the issue of trust. With the rapid growth of cryptocurrency, it’s crucial to only engage with verified and regulated services to ensure your investments are safe.

Illegal Bitcoin ATMs are often part of criminal operations, and by using them, you could unintentionally be supporting illegal activities.

How to Report Illegal Bitcoin ATMs

Reporting illegal Bitcoin ATMs is essential for curbing their use and protecting potential victims. If you suspect an ATM is operating illegally, the first step is to contact local financial authorities or the regulatory body overseeing cryptocurrency transactions in your country.

In the U.S., this would be the Financial Crimes Enforcement Network (FinCEN), while other countries have their own respective agencies.

Provide as much information as possible, including the location of the machine, its operator (if known), and any suspicious activity you may have witnessed.

Many authorities now have online reporting tools to make the process easier. By reporting illegal ATMs, you’re helping law enforcement track down these machines and prevent further fraudulent activities.

In some cases, you may also want to notify the owner of the venue where the ATM is located. They may be unaware that the machine is operating illegally and can take steps to remove it from their premises. Taking these actions not only protects you but also helps safeguard other potential victims.

Here’s how you can take action after identifying fake crypto ATMs:

- How to report: Take note of the ATM’s location. Identify information such as operator details or machine ID and the nature of your concerns. Call your local financial regulatory authority or law enforcement agency to report the illegal Bitcoin machine. Many countries also have hotlines or websites for reporting suspicious financial activity.

- Importance of reporting: Reporting fraudulent Bitcoin ATMs helps law enforcement agencies crack down on such unlawful activities and makes the crypto space safer for everyone. By doing so, you can help protect others from falling into the same trap.

Safeguarding Your Crypto

While illegal Bitcoin ATMs pose risks, staying informed and taking precautions can prevent you from falling victim to scams. Always research before using an ATM to protect yourself from Bitcoin ATMs; it’s better to spend a few seconds researching than fall for a scam.

While the world of cryptocurrency can be unpredictable, with the right knowledge and careful decision-making, you can navigate it safely.

Protecting your cryptocurrency begins with using only regulated and reputable Bitcoin ATMs. Before engaging in any transaction, ensure that the machine is registered with the relevant authorities and that it follows KYC and AML procedures. Always research the operator and be cautious of any ATM that seems to skip important steps like identity verification.

It’s also crucial to keep your digital wallet secure. Never share your private keys or wallet information with anyone, and use strong passwords with two-factor authentication whenever possible. Being aware of common scams and understanding the risks of illegal ATMs will help you avoid becoming a target.

Regularly monitoring your cryptocurrency accounts for unusual activity is another key step in safeguarding your assets. If you notice any unauthorized transactions, report them immediately to both your wallet provider and local authorities. By staying informed and cautious, you can protect yourself from the risks associated with illegal Bitcoin ATMs.

Summary

Illegal Bitcoin ATMs pose serious risks to both novice and experienced investors. These machines bypass regulations, making them a tool for criminals to launder money and defraud users. Understanding how to spot these ATMs, the risks they pose, and how to report them is crucial for anyone engaging in cryptocurrency transactions.

Other Commonly FAQs

- Are Bitcoin ATMs safe to use?

Yes, as long as they are regulated and comply with KYC and AML procedures. - What fees do Bitcoin ATMs charge?

Fees can vary but usually range between 5-15%. Illegal machines may charge much higher fees. - How can I find a legal Bitcoin ATM?

Use online directories that list registered Bitcoin ATMs and check for operator registration. - What should I do if I suspect a Bitcoin ATM is illegal?

Report it to local financial authorities and avoid using the machine. - Can I recover funds lost to an illegal ATM scam?

Recovering funds is difficult but report the scam immediately to authorities to increase the chances of tracking the scammers.