How Debt and Equity Investments Differ in Australia

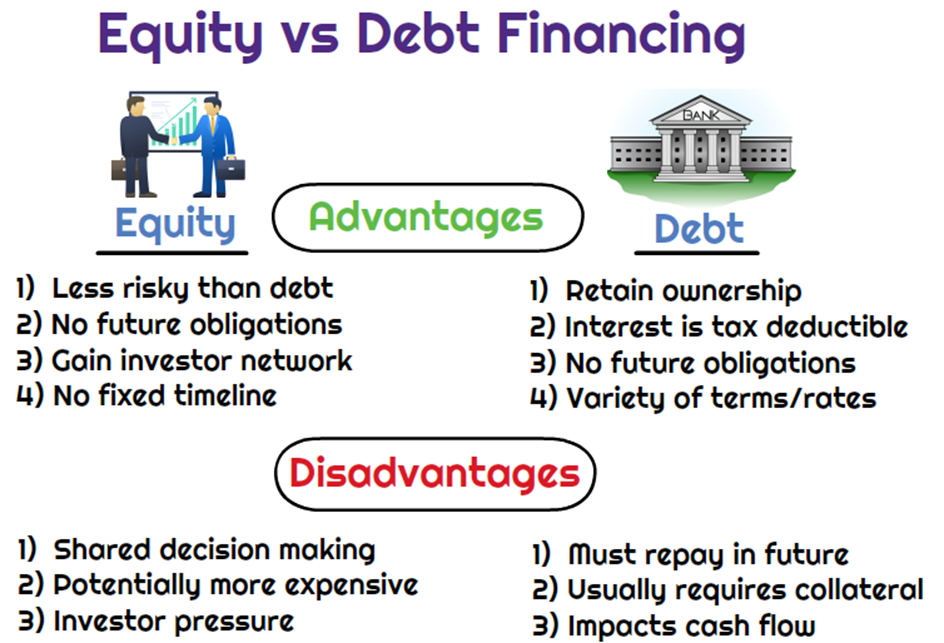

Knowing the difference between debt and equity investments can help you avoid regrets in the future. Starting or expanding a business requires finance which can be sourced from investors. Investing in a business can be done in different ways. The two major ways of investing are debt investment and equity investment.

This article discusses the key differences between Debt and Equity Investments in Australia.

Debt Investment

Debt Investment involves an investor giving a loan to a company based on a loan agreement.

In the agreement, the interest rate will be stated also when the investor will pay the money.

The common types of debt Investment include traditional bank loans, SBA loans, merchant Cash Advances, lines of credit,credit cards etc.

The loan can be secured or unsecured.

For a secured loan, security agreement will be made. This security agreement will secure the loan against all the company’s assets or a specific asset.

In the occasion that the company is not able to pay back the loan, the investor can force them to sell off the asset to get back their money.

For unsecured loans, the investor has no such rights, the only agreement is the loan agreement.

Equity Investment

Equity investment involves investors buying shares in a company at an agreed valuation. They do this in hope that the business will grow and yield a high return on investment.

Common equity investments include venture capitalists angel investors, equity crowdfunding.

Equity investors have a say in the business. They can vote during meetings and they will be paid dividends if the company pays.

An investor can be an ordinary shareholder or buy a preference shares. Preference shareholders have more rights than ordinary shareholders.

Equity investment usually have higher returns than debt investments but the investor must have higher risk tolerance.

Also Read: Is Renting Out Your Car a Good Business Idea in Australia?

How Debt Investment differs from Equity Investment in Australia

Availability

Debt investment may be somewhat difficult if you are just starting your business or you have a poor credit history.

Equity investment is more feasible for startup businesses because investors are looking for businesses they can invest in.

Once there are great chances that your business is profitable and likely to succeed, you can seek equity investors.

Repayment

With Debt Investment, the business owner pays back the loan amount plus interest over a stipulated period of time, mostly in monthly installments.

Equity Investment on the other hand does not involve compulsory repayment. But investors require a return on their capital. Once your business becomes profitable, you pay dividends to your shareholders.

Unlike debt investment where the cost is already predetermined, the cost in equity Investment is variable as it depends on your future earnings and business value.

For debt investments, repayment begins quick, typically the following month after the loan was received. This could be challenging for a startup yet to have a strong financial footing.

Ownership

In debt investment, you retain full ownership of your business. But in equity investment, investors buy a stake in your business. In exchange for decreasing your stake, equity investors can provide financial and non- financial resources that can help your business.

Level of involvement

In Australia, debt Investment differs from equity investment in the level of involvement. Debt investors only provides you with the finance you need and ensures you have the means to repay. They are not involved in managing your business.

Equity investors on the other hand can decide to be involved in taking strategic decisions in the business. They may become board members having a say in taking decisions. You even run the risk of being removed from the management position by other shareholders if they decide to change leadership.

Security

For Debt investments, lenders will require assets like collateral to secure the loan. And in an occasion where the business owner is unable to pay back the loan, the lender can seize the assets to pay back the debt. Equity Investments do not require such security.

Process of raising funds

Fundraising in debt investments is usually faster when you compare it to equity investment. You can get a loan swiftly in days or weeks. Equity Investment takes a lot of time.

You need enough time to find the right investors, draft out terms of the deals and other things. It also involve a lot of legal processes.

Business failure

Debt Investment differs from equity investment in what obtains when a business fails. For debt investment, if the business fails, you will still to pay back your debt. But in equity investment, if the business fails, you will not pay back anything.

Exiting a business

With a Debt Investment, the business owner has full ownership of the business and can exit at any time. Equity investors have a stake in the business and the business owner cannot solely decide to exit the business.

Why Choose Debt Investment or Equity Investment?

The type of investment a business requires depends on the circumstances surrounding the business and the stages it is currently at.

A business can choose debt investment for the following reasons:

- When you have an established business with a reliable cashflow

- You are not ready to share your business with anyone. An indication that you want retain sole ownership of the business.

- A business opts for debt investment when they just want a short term contract that lasts full repayment of loan.

You can chose Equity investment if:

- You are just starting your business, you lack collateral or have a poor financial history.

- You are ready to share your business with others. You are not ready for loan repayments.

- You need the knowledge, network and experience of investors.

- You need a huge amount of money for growing and expanding your business. With equity investments, you can raise large amounts of funds. Rapid upscaling is possible with the large amount of money you can raise with equity Investments.

Also Read: How to Get a Business Line of Credit with Bad Credit in Australia

Conclusion

We have discussed the two major ways investors can invest in a business which are debt and equity investments.

Debt investment differs from equity investments in many ways but neither of them is superior to the other.

Choosing an appropriate investment type depends on the level of risk an investor is willing to take and what a business owner needs.

FAQs

How are debt investments different from equity investments?

Debt investments and equity investments are two distinct types of investments that differ in their nature, structure, and returns.

Here are the key differences:

Debt Investments:

- Loan-Based: Debt investments involve lending money to a company or individual, typically in the form of a loan with a fixed interest rate and repayment terms.

- Fixed Returns: Debt investments provide fixed returns in the form of interest payments, which are usually paid monthly or quarterly.

- Risk Profile: Debt investments are generally considered to be less risky than equity investments, as they are secured by assets or collateral.

- Hold Period: Debt investments typically have a shorter hold period, ranging from a few months to a few years, depending on the loan terms.

- Liquidity: Debt investments are generally more liquid than equity investments, as they can be easily sold or redeemed before maturity.

Equity Investments:

- Ownership: Equity investments involve buying shares of ownership in a company, giving the investor a stake in the company’s profits and losses.

- Variable Returns: Equity investments provide variable returns, which can be in the form of dividends, capital appreciation, or both.

- Risk Profile: Equity investments are generally considered to be riskier than debt investments, as the value of the shares can fluctuate significantly based on market conditions.

- Hold Period: Equity investments typically have a longer hold period, as the investor is holding onto shares of the company for the long term.

- Liquidity: Equity investments are generally less liquid than debt investments, as they can take time to sell or redeem shares

Key Takeaways

- Debt investments are suitable for investors seeking fixed returns and lower risk, while equity investments are suitable for investors willing to take on more risk for potentially higher returns.

- Debt investments are often used for short-term financing needs, while equity investments are used for long-term growth and ownership.

- Both debt and equity investments have their own unique characteristics and risks, and investors should carefully consider these factors before making an investment decision.

By understanding these differences, investors can make informed decisions about which type of investment best fits their financial goals and risk tolerance.

What is the difference between debt and equity finance?

Debt finance is money provided by an external lender, such as a bank. While, equity finance provides funding in exchange for part ownership of your business, such as selling shares to investors.

Debt financing and equity financing are two distinct methods of raising capital for a business.

The key differences between them are:

Debt Financing:

- Borrowing Money: Debt financing involves borrowing money from a lender, typically a bank or financial institution, to fund business operations or projects.

- Fixed Repayment Terms: The borrower agrees to repay the loan with interest over a predetermined period, usually with fixed monthly payments.

- No Ownership Dilution: The borrower retains full ownership of the business and does not give up any shares or equity in the company.

- Risk Profile: Debt financing is generally considered less risky for the borrower, as the loan is secured by assets or collateral and the borrower is obligated to repay the loan.

- Liquidity: Debt financing provides liquidity for the business, as the loan can be used to fund immediate needs and maintain cash flow.

Equity Financing:

- Selling Ownership: Equity financing involves selling shares or ownership in the business to investors in exchange for capital.

- No Repayment Obligation: Equity investors do not require repayment of their investment, as they are essentially buying a stake in the business.

- Ownership Dilution: Equity financing dilutes the ownership of the business, as the investors gain a share of the company’s equity.

- Risk Profile: Equity financing is generally considered riskier for the business, as the investors may have a say in business decisions and the business may be subject to market fluctuations.

- Liquidity: Equity financing can provide liquidity for the business, as the investors can sell their shares if needed, but this may also lead to dilution of ownership.

Key Takeaways

- Debt financing provides a fixed repayment schedule and no ownership dilution, but may require collateral and have higher interest rates.

- Equity financing provides no repayment obligation but dilutes ownership and may involve investor influence.

- The choice between debt and equity financing depends on the business’s financial situation, growth stage, and strategic goals.

In understanding these differences, businesses can make informed decisions about which type of financing best fits their needs and goals.

What is the difference between debt holders and equity holders?

The general difference between debt holders and equity holder are:

Debt holders receive a predetermined interest rate along with the principal amount. While equity shareholders receive a dividend on the company’s profits, but it is not mandatory.

Debt holders and equity holders are two distinct groups of stakeholders in a company, each with their own unique characteristics and interests.

Here are the key differences:

Debt Holders:

- Borrowed Capital: Debt holders are individuals or entities that lend money to a company through a loan agreement, which is typically secured by assets or collateral.

- Fixed Returns: Debt holders receive fixed returns in the form of interest payments, which are usually paid monthly or quarterly.

- Risk Profile: Debt holders are generally considered to be less risky, as they are guaranteed a fixed return and have a higher claim on assets in the event of default.

- Liquidity: Debt holders typically have a shorter hold period, as they can sell their debt securities before maturity.

- No Ownership: Debt holders do not have ownership in the company and do not participate in decision-making processes.

Equity Holders:

- Ownership: Equity holders are individuals or entities that own shares of a company, giving them a stake in the company’s profits and losses.

- Variable Returns: Equity holders receive variable returns in the form of dividends, which are not guaranteed and may fluctuate based on the company’s performance.

- Risk Profile: Equity holders are generally considered to be riskier, as their returns are tied to the company’s performance and they may lose their investment if the company fails.

- Liquidity: Equity holders typically have a longer hold period, as they may need to wait for the company to liquidate or for their shares to be traded on the market.

- Ownership and Decision-Making: Equity holders have ownership in the company and participate in decision-making processes, giving them a greater say in the company’s operations.

Key Takeaways

- Debt holders are lenders who receive fixed returns and have a higher claim on assets in the event of default.

- Equity holders are owners who receive variable returns and participate in decision-making processes.

- The choice between debt and equity financing depends on the company’s financial situation, growth stage, and strategic goals

By understanding these differences, businesses can make informed decisions about which type of financing best fits their needs and goals.

Others Also Read: How to Improve Your Credit Score Fast in Australia

What are the differences between the classification of debt and equity?

The classification of debt and equity reflects the fundamental difference between contractual obligations to repay borrowed funds with interest (debt) and ownership stakes with residual claims on assets and earnings after liabilities are paid, voting rights, and potential for returns through dividends or capital appreciation (equity), with distinct implications for risk, taxation, reporting, and the overall capital structure of a company.

Also, classification of debt and equity is a crucial aspect of financial reporting under International Financial Reporting Standards (IFRS).

The key differences between debt and equity are outlined below:

Debt:

- Obligation to Pay Cash: Debt instruments impose a contractual obligation on the issuer to pay cash or a variable number of shares at a fixed date or upon the occurrence of a specific event.

- Fixed Financial Obligation: Debt instruments create a fixed financial obligation, which means the issuer is committed to making payments, whether it is interest or principal, at a specific date or upon a specific event.

- Mandatory Redemption: Debt instruments often include mandatory redemption features, which require the issuer to redeem the instrument at a predetermined date or upon the occurrence of a specific event.

- Interest Payments: Debt instruments typically involve interest payments, which are mandatory and must be made by the issuer.

- Risk Profile: Debt instruments are generally considered to be less risky for the issuer, as the issuer is obligated to make payments and the risk is transferred to the lender.

Equity:

- Discretion Over Cash Payments: Equity instruments do not impose a contractual obligation to pay cash, and the issuer has discretion over cash payments.

- No Fixed Financial Obligation: Equity instruments do not create a fixed financial obligation, and the issuer is not obligated to make payments unless they choose to do so.

- No Mandatory Redemption: Equity instruments do not include mandatory redemption features, and the issuer is not obligated to redeem the instrument at a predetermined date or upon the occurrence of a specific event.

- Dividend Payments: Equity instruments often involve dividend payments, which are discretionary and may not be made by the issuer.

- Risk Profile: Equity instruments are generally considered to be riskier for the issuer, as the issuer has no obligation to make payments and the risk is transferred to the investor.

Key Clauses to Assess:

- Dividend or Interest Rights: The presence of dividend or interest rights associated with the instrument is a key factor in determining whether it should be classified as debt or equity.

- Redemption Rights: The redemption features of an instrument, including mandatory redemption, redemption at investor discretion, and redemption at issuer discretion, play a significant role in its classification as debt or equity.

- Embedded Derivatives: Instruments that contain embedded derivatives, such as interest rate caps and floors, conversion features, and equity kickers, need to be accounted for separately and can impact the classification of the instrument.

Conclusion

The classification of debt and equity is crucial for financial reporting and has significant implications for the presentation and measurement of these instruments on the balance sheet. Understanding the key differences between debt and equity, including the obligation to pay cash, fixed financial obligations, mandatory redemption, interest payments, and risk profiles, is essential for accurate financial reporting.

What is the distinction between debt and equity markets?

The distinction between debt and equity markets lies in the nature of the financial instruments traded and the characteristics of the issuers and investors involved.

The debt market, also known as the bond market or the credit market, is where debt instruments such as bonds, debentures, and other fixed-income securities are issued and traded. In this market, borrowers (typically governments, corporations, or other entities) issue debt instruments to raise capital, and investors (lenders) provide the funds in exchange for fixed periodic interest payments and the eventual repayment of the principal amount.

On the other hand, the equity market, also known as the stock market, is where ownership stakes in companies are bought and sold. In this market, companies issue shares (equity securities) to raise capital, and investors (shareholders) acquire these shares, becoming partial owners of the company. Shareholders have the potential to earn returns through dividends (if declared) and capital appreciation (if the share price increases).

The key distinctions between debt and equity markets are:

- Nature of the instrument: Debt instruments represent loans with fixed repayment terms, while equity instruments represent ownership stakes.

- Risk and return: Debt instruments are generally considered less risky than equity instruments, offering fixed returns in the form of interest payments. Equity instruments are riskier but offer the potential for higher returns through dividends and capital appreciation.

- Claim on assets: In case of a company’s liquidation, debt holders have a higher priority claim on the company’s assets compared to equity holders.

- Voting rights: Debt holders typically do not have voting rights in the company’s decision-making, while equity holders (shareholders) have voting rights and can influence the company’s management and strategic decisions.

- Taxation: Interest payments on debt instruments are generally tax-deductible for the issuer, while dividend payments to shareholders are not tax-deductible.

- Regulation and oversight: Debt and equity markets are often subject to different regulatory frameworks and oversight bodies, with varying levels of disclosure requirements and investor protection measures.

While both debt and equity markets serve the purpose of raising capital, they cater to different risk appetites, investment objectives, and financing needs of issuers and investors.

What is equity financing

Equity financing refers to the process of raising capital by selling ownership stakes or shares in a company. It involves issuing equity securities, such as common stock or preferred stock, to investors in exchange for their investment capital.

The key characteristics of equity financing are:

Ownership stake:

Investors who provide equity financing become partial owners or shareholders of the company. They hold equity shares that represent their ownership interest in the business.

Residual claim:

Equity shareholders have a residual claim on the company’s assets and earnings after all liabilities have been paid off. This means that if the company is liquidated, shareholders will be entitled to a share of the remaining assets after creditors and debt holders have been paid.

Voting rights:

Equity shareholders typically have voting rights, allowing them to participate in the decision-making process of the company, such as electing the board of directors and voting on major corporate actions.

No fixed returns:

Unlike debt financing, equity financing does not guarantee fixed returns. Shareholders’ returns come in the form of dividends (if declared by the company) and potential capital appreciation if the company’s stock price increases over time.

Risk and reward:

Equity financing is generally considered riskier than debt financing because shareholders’ returns are not guaranteed, and they bear the risk of potential losses if the company performs poorly. However, the potential rewards for equity investors can be higher if the company succeeds and grows.

Equity financing can be raised through various channels, such as initial public offerings (IPOs), follow-on offerings, private placements, or venture capital investments. Companies often pursue equity financing to fund growth opportunities, expand operations, finance acquisitions, or restructure their capital structure.

In summary, the main distinction is that debt investors are lenders who receive fixed payments, while equity investors are owners who receive variable returns based on the company’s performance. This difference in risk and return profile is the primary factor that distinguishes debt and equity markets.

Equity financing examples

Here are some common examples of equity financing:

Initial Public Offering (IPO):

When a private company goes public for the first time by issuing shares to the public through a stock exchange, it is considered an IPO. IPOs are a way for companies to raise significant capital and allow existing investors to partially cash out.

Follow-on Public Offering: Companies that are already publicly traded can raise additional equity capital by issuing new shares in a follow-on public offering (FPO) or secondary offering.

Private Placement:

Private companies can raise equity financing by issuing shares to a select group of investors through a private placement, often targeting institutional investors, venture capitalists, or high-net-worth individuals.

Venture Capital Financing:

Startup and early-stage companies often raise equity financing from venture capital firms or angel investors in exchange for ownership stakes. Venture capitalists provide capital and expertise to help companies grow and eventually exit through an IPO or acquisition.

Crowdfunding:

With the rise of crowdfunding platforms, companies (especially smaller businesses and startups) can raise equity financing from a large pool of individual investors through online campaigns.

Employee Stock Ownership Plans (ESOPs):

Companies can offer employees ownership stakes or stock options as part of their compensation packages, essentially using equity as a form of financing to attract and retain talent.

Strategic Equity Investments:

Companies may also raise equity financing by selling stakes to strategic investors, such as larger corporations or industry partners, who are interested in gaining a foothold in the company’s business or market.

Convertible Securities:

Companies can issue convertible preferred shares or convertible debt instruments that can be converted into equity shares at a later date, providing an option for equity financing.

These examples highlight the various ways companies can raise equity financing to support their growth, operations, and strategic objectives, while also allowing investors to participate in the potential upside of the company’s success.

Debt financing

Debt financing refers to the process of raising capital by borrowing funds from lenders or creditors, which must be repaid over a specified period, typically with interest. It involves issuing debt instruments, such as bonds, loans, or notes, to investors or financial institutions.

The key characteristics of debt financing are:

- Borrowed capital: Companies receive funds from lenders or creditors, which they are contractually obligated to repay according to the terms of the debt agreement.

- Interest payments: In exchange for providing the borrowed capital, lenders receive periodic interest payments from the borrower (company) until the debt is fully repaid.

- Fixed repayment schedule: Debt financing typically involves a fixed repayment schedule, where the borrower must make regular payments (principal and interest) over a predetermined period until the debt is fully repaid.

- Collateral or security: In many cases, debt financing requires the borrower to pledge collateral or assets as security for the loan, which can be seized by the lender if the borrower defaults on repayments.

- Priority claim: In the event of bankruptcy or liquidation, debt holders (creditors) have a higher priority claim on the company’s assets compared to equity holders (shareholders).

- Tax-deductible interest: Interest payments made on debt financing are generally tax-deductible for the borrowing company, providing a tax advantage compared to equity financing.

Common examples of debt financing include:

- Bank loans: Companies can obtain loans from commercial banks or other financial institutions, which can be secured (backed by collateral) or unsecured.

- Bonds: Companies can issue bonds to raise debt capital from institutional and individual investors. Bonds are long-term debt instruments with specified maturity dates and interest rates.

- Debentures: Debentures are similar to bonds but are typically unsecured, meaning they are not backed by specific collateral.

- Lines of credit: Companies can obtain revolving lines of credit from banks, which allow them to borrow funds as needed up to a predetermined limit.

- Commercial paper: Large, creditworthy companies can issue short-term, unsecured promissory notes called commercial paper to raise funds from investors.

Debt financing can provide companies with access to capital without diluting ownership, but it also increases financial risk and obligations. Companies must carefully manage their debt levels and ensure they have sufficient cash flows to make timely interest and principal payments. The choice between debt and equity financing often depends on the company’s financial situation, growth stage, and overall capital structure strategy.

What are the pros and cons of equity financing?

Equity financing has both advantages and disadvantages for companies. Here are some of the key pros and cons:

Pros of Equity Financing:

1. No debt obligations: Equity financing does not create debt obligations or interest payments, reducing the company’s financial risk and potential for default.

2. Permanent capital: The funds raised through equity financing become a permanent part of the company’s capital structure and do not need to be repaid.

3. Shared risk and reward: Equity investors share both the risks and rewards of the business, aligning their interests with the company’s long-term success.

4. Improved creditworthiness: Raising equity capital can improve a company’s creditworthiness and ability to obtain debt financing on better terms in the future.

5. Expertise and connections: Equity investors, such as venture capitalists or strategic partners, may provide valuable expertise, industry connections, and access to resources.

Cons of Equity Financing:

1. Dilution of ownership: Issuing new shares dilutes the ownership stakes of existing shareholders, potentially reducing their control and influence over the company.

2. Loss of control: Depending on the amount of equity issued, the company may have to give up a significant portion of ownership and decision-making power to new investors.

3. Profit sharing: Equity investors expect a share of the company’s profits through dividends or capital appreciation, potentially reducing the returns for existing shareholders.

4. Disclosure requirements: Public companies issuing equity may be subject to stricter disclosure requirements and regulatory oversight, increasing compliance costs.

5. Potential for undervaluation: If a company’s shares are undervalued at the time of issuance, it may result in the company receiving less capital than the actual value of the equity issued.

6. Cost and complexity: Equity financing can be more complex and expensive compared to debt financing, involving investment banks, legal fees, and other associated costs.

The decision to pursue equity financing depends on the company’s specific circumstances, growth stage, capital requirements, and its ability to attract potential investors. Companies often weigh the advantages and disadvantages of equity financing against other financing options, such as debt financing or retained earnings, to determine the most suitable approach to raising capital.

Read Also: Learning About Finance: A Simple Guide