Glacier Insurance Review (2024): Pros And Cons

Glacier Insurance Company is a company that is well worth taking into consideration if you are shopping for auto insurance. We’ll go into every facet of their coverage, costs, claims procedure, customer support, and more in this in-depth analysis. Upon completion, you will possess a comprehensive comprehension of Glacier Insurance Company’s offerings and their suitability for your vehicle insurance requirements.

Glacier Insurance Monthly Rates vs U.S. Average

Determining the Price: Glacier Insurance Company Car Insurance Costs

Several factors might cause the cost of car insurance from Glacier Insurance Company to vary dramatically. Policyholders should budget between $44 and $121 a month on average. It’s crucial to remember that individual rates could vary depending on a number of factors, including your location, driving record, kind of car you drive, and the coverage options you choose.

- Location: Your geographical area plays a significant role in determining the cost of car insurance. Urban areas often have higher premiums due to increased traffic and a higher risk of accidents or theft.

- Driving History: Your personal driving record is a crucial factor. Safe drivers with a clean history tend to enjoy lower rates, while those with accidents or traffic violations may pay more.

- Vehicle Type: The make and model of your car can influence insurance costs. Newer, more expensive vehicles often have higher premiums due to the cost of repairs or replacement.

- Coverage Options: The level of coverage you choose will directly impact your premium. Comprehensive coverage with additional features may result in higher costs.

- Discounts: Glacier Insurance Company offers various discounts, and your eligibility for these discounts can significantly reduce your premium. These may include safe driver discounts, multi-policy discounts, and good student discounts, among others.

When choosing an auto insurance policy, it is crucial to comprehend the cost of coverage. Even though Glacier Insurance Company has affordable rates, a number of factors affect how much you’ll really pay.

For an accurate quotation that takes into account your particular situation, it is best to acquire a personalized quote from Glacier Insurance Company. You may find the ideal balance between affordable auto insurance and comprehensive coverage by carefully weighing these pricing criteria.

Though it may not seem familiar to some, Glacier Auto Insurance has been actively providing policies to motorists in the Midwest for more than 55 years, with an emphasis mostly on auto insurance.

Like the majority of auto insurance providers, Glacier offers completely customisable auto coverage, so you can decide what you need and only pay for it. Because Glacier only conducts business in Delaware, Pennsylvania, Indiana, and Ohio, its policies are carefully tailored to satisfy the legal minimums set forth by each of these states.

Glacier offers a variety of auto insurance plans, from basic to comprehensive coverage. The company also offers high-risk coverage, commonly referred to as non-standard insurance, for drivers who are deemed high-risk because of a history of moving infractions or a bad credit history.

Just to add, when you get a quotation from Glacier, you can save up to 10% on your auto insurance if you’re the kind of person who looks for deals when buying for insurance.

This entails flexible payments plans and a minimal down payment.

It takes little time to enroll, and you will receive an instant ID card as proof of insurance.

The state availability of Glacier insurance is a minor drawback. The company only offers insurance in a few Midwesterner states in the United States.

You’ll have a better grasp of Glacier’s policy after reading our assessment, complete with advantages and disadvantages!

About Glacier Insurance

The official name of Glacier Insurance is Glacier Insurance Company. It was founded in 1968 and has its headquarters in Blue Bell, Pennsylvania. Glacier is accessible in four states: Delaware, Pennsylvania, and Indiana and Ohio were added to its service area in 2022.

The company’s sole insurance offering at the moment is auto insurance.

Glacier car insurance coverage

Glacier provides drivers with a selection of coverage options. Remember that you should be aware of the minimal coverage necessary by your state when selecting an auto insurance policy.

For instance, if you live in Pennsylvania, you should have the following minimum amount of auto insurance:

- $15,000 in bodily injury per person

- $30,000 in total bodily injury per accident

- $5,000 in property damage per accident

- First party benefits: $5,000

In Delaware, the minimum requirements are:

- $25,000 in bodily injury per person

- $50,000 in total bodily injury per accident

- $10,000 in property damage per accident

- $15,000 per person for PIP

- $30,000 per accident for PIP

The aforementioned specifications are the very minimum; based on your needs, you can still select greater limitations to strengthen your protection.

These are the coverages that Glacier offers:

- Liability insurance coverage: This will pay for costs associated with any physical harm you inflict to another person while operating a vehicle. It also covers property damage liability, which will cover losses incurred by third parties due to property damage. The minimum BI liability per person in Pennsylvania is $15,000, and the minimum PD liability per accident is $5,000. Be aware that neither personal injury nor vehicle damage will be covered by this policy!

- Collision coverage: This insurance will pay for the costs of replacing or repairing your car if it is damaged in an accident involving another car or item.

- Comprehensive: Covers repairs or replacement costs for non-collision-related vehicle damage. This covers harm caused by theft, falling items like trees, fire, hail, and vandalism.

- High-risk coverage: In order to lawfully drive, drivers who might not be qualified for coverage from traditional insurance providers must select the high-risk policy. If you fit into this category, your insurance premium will probably be higher.

Also check our review of » Look non-standard auto insurance

Roadside Assistance

If your car breaks down while driving, the Glacier roadside assistance add-on coverage can come in handy. Towing and hook-up to any repair facility up to 15 miles away are included in the services. In addition, it provides lockout help in the event that you inadvertently lock your keys inside the car, jump starts a dead battery, fixes flat tires, and fuel delivery.

You are limited to three calls for roadside assistance per six months!

Additionally, you have the option to include the coverage in your insurance if you use your vehicle for ridesharing services like Uber and Lyft.

SR-22S Filing

Drivers may be forced to complete an SR-22 form if they have broken any driving laws or if there has been a gap in their insurance. Glacier can submit the form to the state on your behalf if this is the case.

Discounts

There is just one auto insurance discount available via Glacier. On their website, it states that when you buy an insurance online, you can receive an additional 10% off your coverage.

Cost of Glacier auto insurance

The true cost of Glacier’s auto insurance varies significantly. This is mostly due to the fact that a plethora of factors, like as your zip code, vehicle make and model, driver profile, set limits, and deductible, all affect your premiums.

Pennsylvania and Delaware had annual average premiums for full auto insurance coverage of $2,040 and $2,103, respectively, according to Bankrate. Ohio and Indiana have slightly lower rates, at $1,599 and $1,266 respectively.

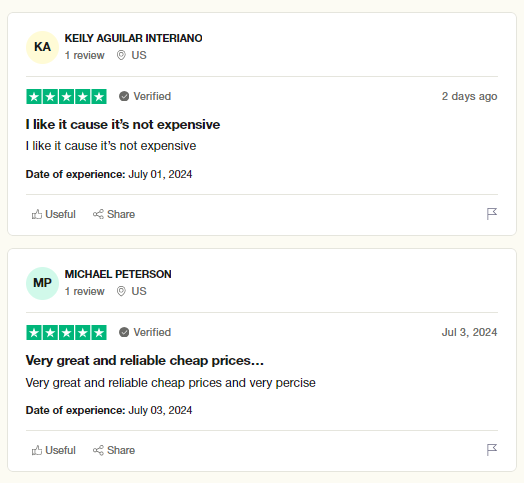

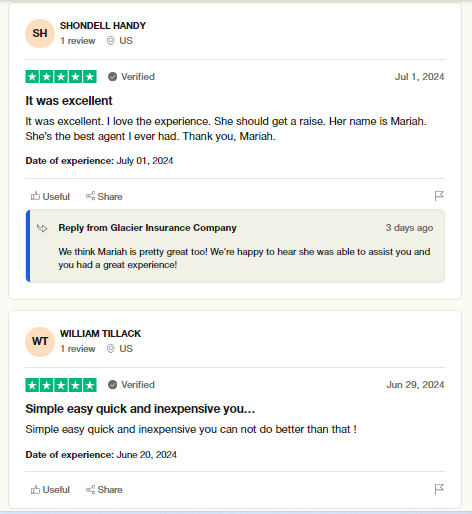

Consumer complaints and reviews

While there are still few negative consumer ratings of Glacier available on Trustpilot, the most of them are encouraging. With more than 540 reviews, Glacier Insurance has a 4.7-star rating on Trustpilot. This demonstrates rather plainly how happy customers are with their service.

Glacier ratings

An insurance company’s quality and financial stability can also be verified with the aid of ratings from third-party sources.

Glacier has an A+ accreditation and a BBB rating. The company has an A rating on Demotech, indicating high financial stability.

- BBB: A+

- Demotech: A

Pros and cons

Pros

- 10% discount on auto policy

- Cheap rates with high customization

- Mobile app

Cons

- Limited availability

- Poor customer service reported by some users

Glacier Insurance app

Glacier has a user-friendly mobile app for seamless management of all account-related activities. Policyholders can also make quick monthly payments on the app. It is available on the App Store and Google Play.

How to get a quote

- Go to their website and fill in the zip code field with your address.

- You will be prompted to provide details on the screens that follow, such as the year, make, model, and body style of your vehicle.

- After that, you may go ahead and finish the quote process after reviewing the coverage you have chosen.

You can also call a Glacier customer representative at 1-800-291-3972 to get a better idea of the whole policy.

Frequently Asked Questions (FAQs)

How to file a claim with Glacier auto insurance

Call 800-394-2423 to talk with a Glacier claims agent.

Policyholders can also submit a claim at the same time by emailing claims@glacierinsurance.com.To support your claim, if at all possible, submit pictures and videos of the occurrence with your claim.

Additionally, Glacier advises you to send the email with your policy number in the subject line.

How to pay bills or make payments on Glacier insurance

You can pay your monthly premiums by visiting the online portal. Accepted payment methods are Visa and Mastercard.

Other payment options include automatic payments by EFT or RCC. You can also send a check or money order to process your payment.

Does Glacier issue life insurance?

No. At the time of writing, Glacier only sells auto insurance.

Is Glacier Insurance legit?

Glacier Insurance Company has been around for over 55 years. The company is rated A+ by BBB and rated A on Demotech which indicates a strong financial standing. Positive reviews from several customer review sites like Trustpilot say a lot more.

Is Glacier good at paying claims?

Yes, based on its financial stability rating on Demotech, you can expect to get your claims paid faster.

Frequently Asked Questions

What is Glacier Insurance Company?

Glacier Insurance Company is an insurance provider that offers various types of insurance coverage, including car insurance.

What does the car insurance review cover?

The car insurance review covers an analysis of Glacier Insurance Company’s car insurance policies, coverage options, customer service, claims process, and overall customer satisfaction.

What are the key features of Glacier Insurance Company’s car insurance?

The key features of Glacier Insurance Company’s car insurance include customizable coverage options, competitive rates, flexible payment plans, roadside assistance, and a user-friendly online platform for managing policies and claims.

How can I contact Glacier Insurance Company for car insurance?

You can contact Glacier Insurance Company for car insurance by calling their customer service hotline at [phone number] or by visiting their website and requesting a quote or more information.

What factors should I consider when choosing car insurance?

When choosing car insurance, it is important to consider factors such as coverage options, deductibles, premiums, customer reviews, claims handling process, discounts available, and the financial stability and reputation of the insurance company.

Are there any discounts available with Glacier Insurance Company’s car insurance?

Yes, Glacier Insurance Company offers various discounts for car insurance, such as safe driver discounts, multi-policy discounts, good student discounts, and discounts for certain safety features installed in your vehicle.

Can I file a car insurance claim online with Glacier Insurance Company?

Yes, Glacier Insurance Company provides an online claims submission process where you can report and file a car insurance claim easily. They also have a dedicated claims department to assist you throughout the process.