Proven Strategies to Boost Your Credit Score and Build Wealth

An excellent credit score can save you hundreds of thousands of dollars over your lifetime. However, many people try futile tactics to improve their credit scores. Some people assume that having a balance on a credit card helps develop credit, but this is a misconception. According to the Consumer Financial Protection Bureau, paying off credit cards in full each month is the best way to improve and maintain a strong credit score over the long term.

The wealthy benefit from high credit scores, allowing them to secure cheaper rates, invest more profitably, and borrow at better terms. Conversely, those with poor credit scores face obstacles when borrowing money, purchasing or renting cars, and buying or renting homes. If a recession occurs in 2024 or 2025, those with the least debt will be in a better position. Currently, America holds over $1 trillion in credit card debt, the highest in history. This article will explore how debt levels vary by age and provide actionable strategies to improve your credit score quickly, helping you stand out and build wealth.

Data reveals interesting trends: Generation X and Baby Boomers carry the highest debt levels, likely due to their higher incomes and lifestyle costs. Millennials are not far behind. Alarmingly, average debt has increased steadily across all age groups. Becoming debt-free within the next one or two years will put you ahead. Paying off debt shows lenders you are trustworthy, which boosts your credit score.

A higher credit score demonstrates dependability to lenders, resulting in lower lending rates, promotional offers, and incentives. First, let’s look at average credit scores by age and then discuss how to increase them. FICO divides credit ratings into six categories: extremely poor (300-579), poor (580-669), fair (670-739), excellent (740-799), very good (800-850), and exceptional (850+). Gen Z has an average score of 680, Millennials 690, Gen X 709, Baby Boomers 745, and Silent Generation 760.

Credit scores are calculated using a variety of parameters, including your credit utilisation ratio, account types, and repayment history, all of which are recorded in your credit report by the three major bureaus: Experian, Equifax, and TransUnion.

Although the process used by VantageScore and FICO differs slightly, their credit score ranges are generally similar.

Let’s now examine how your credit score is determined and rank the most important factors. Before we get started, let us hear from our sponsor. Ki is the first legal financial exchange in the United States, established by two technologists from MIT.

where you can bet on events affecting companies, like inflation or interest rates. It functions like the stock market but focuses on betting on events instead of stocks. For instance, if you believe the Federal Reserve will cut interest rates by June 2024, you can buy shares of that prediction. Prices shift according to market odds, allowing you to potentially profit even before the event concludes.

Back to your credit score. The first factor is credit usage, which refers to how much credit you’ve used. For example, if your credit limit is $5,000 and you consistently max it out, it negatively impacts your score. The next factor is the age of your credit accounts—the longer, the better. Your credit mix, or the variety of accounts you hold (e.g., credit cards, mortgages), also matters. Another factor is new credit accumulation; opening too many new accounts can hurt your score. Lastly, payment history is crucial—are you paying on time?

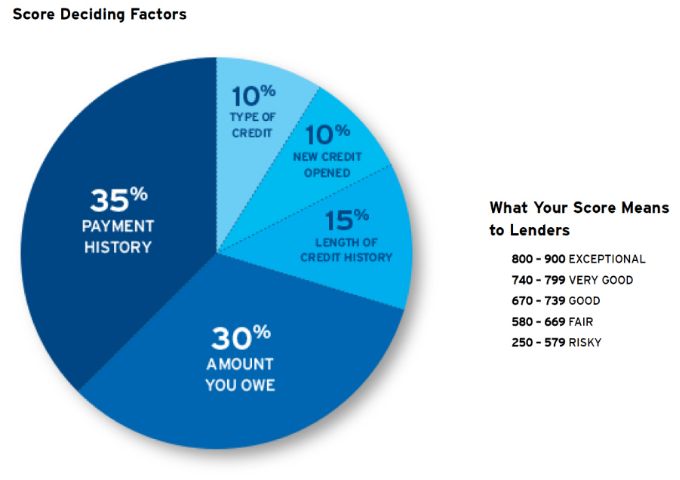

Knowing what influences your score is important, but understanding their proportional relevance is even more critical. Payment history is the most important factor, accounting for 35% of your score. The amount of credit owing ranks second, accounting for 30% of the total. Together, these two categories make up 65% of your score, meaning that missing payments or using too much credit will have a major impact. The length of your credit history accounts for 15%, while credit mix and new credit accumulation each contribute 10%.

To improve your credit score, here are some tips. First, ensure all loans, credit card bills, and other monthly payments are made on time. This is the most critical factor. Second, pay off your credit card balances in full each month. Carrying a balance negatively affects both your payment history and credit utilization, which together make up 65% of your score. Ideally, keep your credit utilization under 30%. For example, if your credit limit is $5,000, don’t carry more than $1,500 in debt at any time.

You can also request a credit limit increase to help improve your utilization rate. For example, raising your limit to $10,000 allows you to use up to $3,000 while staying under the 30% utilization mark. However, be cautious—if a higher limit encourages you to spend more, it’s better to focus on keeping your utilization low. Avoid applying for new credit unless necessary, and keep unused accounts open. Some people celebrate paying off credit cards by closing them, but this hurts your score by reducing the length of your credit history. Instead, keep the accounts open, even if you’re not using them.

With a good credit score and sound financial habits, you can seize opportunities others might miss. To find out more about the best high-yield savings accounts, check out my other articles. If you’re looking for a simple, powerful way to invest using a three-fund portfolio, read my next article.

FAQs

1. What is a credit score, and why is it important?

A credit score is a numerical representation of your creditworthiness, based on your credit history. Lenders use it to evaluate your ability to repay loans or credit. A higher credit score can help you secure better interest rates, lower fees, and access to more favorable financial products like mortgages, car loans, or credit cards.

2. What factors affect my credit score the most?

The major elements that affect your credit score are:

- Payment history (35%): Paying bills on time is critical.

- Credit utilisation (30%): Using too much of your available credit might reduce your score.

- Credit history length (15%): The longer you’ve held credit accounts, the better.

- Credit mix (10%): A broad credit portfolio, including credit cards and loans, is beneficial.

- New credit enquiries (10%): Opening too many accounts in a short period of time might lower your credit score.

3. How can I improve my credit score quickly?

To quickly raise your credit score, you can:

- Pay all bills on time, especially for credit cards and loans.

- Reduce your credit card balances to lower your credit utilization ratio.

- Avoid opening new accounts unless absolutely necessary.

- Check for errors on your credit report and dispute any inaccuracies.

4. Does carrying a balance on my credit card help build credit?

No, carrying a balance does not help your credit score. In fact, paying off your balance in full each month is the best way to build and maintain a high credit score, as it positively impacts both your payment history and credit utilization.

5. What is the ideal credit utilization ratio?

The ideal credit utilization ratio is below 30% of your total available credit. For example, if you have a credit limit of $10,000, it’s best to keep your outstanding balance below $3,000.

6. How long does it take to improve a credit score?

The time it takes to improve your credit score depends on your starting point and the steps you take. For minor improvements, you might see results within 30-60 days. However, more significant improvements, such as recovering from missed payments or high credit utilization, could take several months to a year or longer.

7. Will checking my credit report affect my score?

No, checking your own credit report is considered a “soft inquiry” and does not impact your score. It’s a good idea to regularly review your credit report to ensure all information is accurate.

8. Can paying off debt increase my credit score?

Yes, paying off debt, especially credit card balances, can improve your credit score by lowering your credit utilization and showing lenders that you’re responsible with credit.

9. How does opening new credit affect my score?

Opening a new credit account can lower your score in the short term due to the “hard inquiry” and reduced average age of your credit accounts. However, if managed responsibly, it can improve your score over time by increasing your available credit and improving your credit mix.

10. What should I do if I find an error on my credit report?

If you find an error, contact the credit bureau (Experian, Equifax, or TransUnion) to dispute the information. Provide evidence to support your claim, and the bureau is required to investigate and correct inaccuracies.