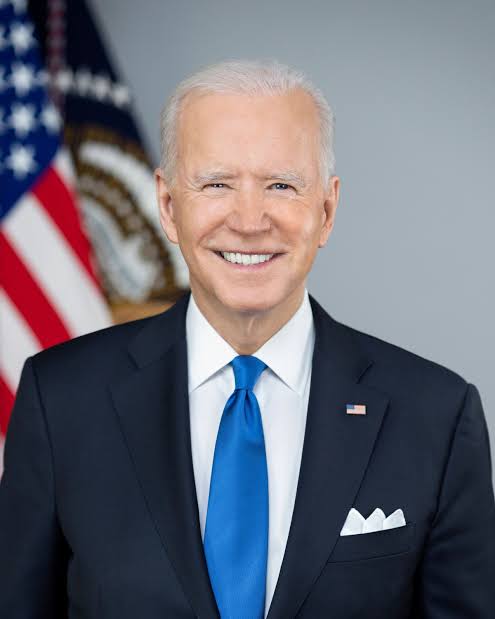

Biden Student Loan and Save Plan: Everything You Need To Know

On Monday, President Biden unveiled specifics of his new plan to cancel over 30 million Americans’ student loan debt.

The plan still needs to be formalized and will likely face legal hurdles, similar to the ones that derailed Mr. Biden’s initial attempt to completely eliminate student debt last year.

If the new initiative proceeds following the mandatory, months-long comment period, Biden administration officials indicated they might start distributing some of the debt relief — including the cancellation of up to $20,000 in interest — as early as this fall.

What is currently known about the program is as follows:

Who would the new plan benefit?

For over four million Americans, the plan would eliminate all debt and lower payments for 25 million debtors. According to officials, a total of 10 million borrowers would receive debt relief of $5,000 or more.

What Is Biden’s Save Plan

The Biden-Harris administration thinks that continuing education after high school should provide doors to opportunities rather than trap borrowers in unmanageable debt. Because of this, President Biden and Vice President Harris have been attempting to improve the student loan system and lower the cost of college since day one. The Savings on a Valuable Education (SAVE) plan, the most economical repayment plan ever developed, officially launched today, according to the Biden-Harris Administration. To encourage qualified borrowers to enroll in the plan, an outreach effort was launched.

The SAVE plan is an income-driven repayment (IDR) plan that forgives leftover liabilities after a predetermined number of years. Payments are determined by the borrower’s income and family size rather than their loan balance.

The SAVE plan will prevent balances from rising due to unpaid interest, save other borrowers around $1,000 annually, eliminate many borrowers’ monthly payments, and accelerate the process of getting more debtors closer to forgiveness. The SAVE proposal expands on the measures already implemented by the Biden-Harris Administration to assist borrowers and students, such as the cancellation of over $116 billion in student loan debt for 3.4 million Americans.

Over 20 million borrowers, according to the Biden-Harris Administration, might profit from the SAVE plan. Borrowers can register right now at StudentAid.gov/SAVE.

Biden Student Loan Debt Release Supreme Court

According to Washington CNN – Even though President Joe Biden’s landmark student loan forgiveness program was overturned by the Supreme Court in late June, his administration has already discovered ways to erase more than $48 billion in debt.

The cancellations have been made possible by federal student debt forgiveness programs that are now in place. These programs are restricted to certain groups of borrowers, including those who have paid for at least 20 years, those who work in the public sector, and those who were duped by for-profit universities.

The rejected forgiveness plan, which would have erased roughly $430 billion of the $1.6 trillion in federal student loan debt all at once, is not related to these programs.

Since taking office, the Biden administration has been gradually canceling student loans through these already-existing programs. Almost 3.6 million people have benefited from a total of $127 billion in loan discharges.

Because of the Biden administration’s attempts to temporarily expand certain debt relief programs and to fix previous administrative errors made to borrowers’ student loan accounts, more student loan forgiveness was awarded than under any previous administration. The measures are in sharp contrast to those of the Trump administration, which attempted to slow down the processing of certain applications and limit certain of these forgiveness programs.

However, Biden’s Republican opponents claim that he is trying to get around the Supreme Court’s decision and that at least some of his debt relief initiatives are unlawful.

The impacted groups consist of:

— Up to $20,000 of the interest owed by borrowers whose loan balances have increased due to interest will be canceled. For borrowers classified as “low- and middle-income,” who are engaged in the administration’s income-driven repayment plans, the plan would forgive the whole interest balance.

The biggest relief mechanism in the plan would be the interest forgiveness, which would be a one-time benefit. Of the 25 million borrowers who potentially benefit from this waiver, the administration calculates that 23 million would have their entire interest balance wiped off.

— Debts would be immediately canceled for borrowers who qualify for loan forgiveness under current programs like Public Service Loan Forgiveness or the administration’s new repayment plan, SAVE, but have not yet filed for it.

— Debt cancellation would be granted to borrowers with undergraduate student loans who began making loan repayments more than 20 years ago, as well as graduate students who began making loan payments 25 years or more ago.

– Debts would be waived for borrowers who enrolled in programs or universities that lost government support as a result of defrauding or cheating students. Relief would also be available to students who attended schools or programs that left them with mountains of debt and little chance of employment or income.

— Relievers may also be available to borrowers who are in “hardship” repaying their debts due to rising medical or child care expenses. Although the administration has not yet decided how these debtors would be identified, it is thinking of automatically forgiving those who are in danger of missing payments.

What distinguishes this plan from the previous one?

Using the Higher Education Relief Opportunities for Students Act of 2003, or HEROES Act, which the administration claimed allowed the government to waive student debt during a national emergency like the Covid-19 pandemic, Mr. Biden first attempted to grant $400 billion in debt relief for 40 million borrowers.

The Supreme Court said that Mr. Biden had overreached himself and stopped that action.

The Higher Education Act, a federal statute that governs student loan and grant programs, would allow the new plan to forgive all or part of the debt owed by roughly 30 million borrowers. Instead of providing widespread loan forgiveness, the administration thinks it can operate within the more restrictive parameters of that statute by focusing on particular borrower groups.

According to the Biden administration, attorneys for the White House and Education Department reviewed the Supreme Court’s decision from the previous year and made sure the new program complied with the justices’ guiding principles.

However, there may be concerns about whether the borrowers under the most recent proposal would be regarded as “limited,” as the Higher Education Act mandates, as stated by the Supreme Court, or if the administration has once more overreached its bounds.

FAQs

What is the plan for SAVE?

A new IDR plan is called SAVE. The SAVE plan uses a different mechanism for calculating payments than the other IDR plans, which use your discretionary income, which is defined as the difference between your income and 150% of the federal poverty threshold for your household size. More of your income is protected since it views your discretionary income as the difference between your income and 225% of the federal poverty threshold.

Additional benefits will be implemented in 2024.Among these benefits is the ability to have loans erased after just ten years for borrowers with balances under $12,000.

The current Revised Pay As You Earn (REPAYE) Plan will be replaced with the SAVE plan. You will be registered in SAVE automatically if you are currently enrolled in the REPAYE Plan.

How is the SAVE plan implemented?

Because SAVE determines your discretionary income using a larger percentage of the federal poverty threshold, it lowers payments for borrowers enrolled in IDR plans.

Assume you are a single person with a $30,000 yearly income. Your discretionary income would be calculated as the difference between your $30,000 salary and 150% of the federal poverty guideline for an individual under the present IDR schemes. The 2023 guidelines state that a single person should make $14,580; 150% of that amount is $21,870.

Your discretionary income under the current IDR schemes would be $8,130. Depending on the plan, you could spend anywhere from $813 to $1,626 annually, or up to 10% to 20% of your disposable income.

For instance, under the SAVE plan, borrowers who are single and make $32,800 or less, or households with four members who make $67,500 or less (though the thresholds are higher in Alaska and Hawaii), will be eligible for $0 in payments. The new scheme would enable borrowers switching from another plan to SAVE to save thousands of dollars annually.

For whom is the SAVE plan eligible?

The SAVE repayment plan is available to any borrower with federal student loans that meet certain requirements. Loans that qualify include:

- Direct loans, both subsidized and unsubsidized

- Graduate or professional students are eligible for Direct PLUS loans.

- Parent PLUS loans were not repaid by the direct consolidation loans.

If you combine these loan kinds with a straight consolidation loan, you can also qualify for SAVE:

- FFEL loans that are subsidized and unsubsidized

- Loans from FFEL Plus given to professional or graduate students

- Loans for FFEL consolidation

- Loans from Perkins

You will be enrolled in SAVE automatically if you were previously on the Revised Pay As You Earn (REPAYE) plan. If not, you can submit an IDR plan request on the Federal Student Aid website to apply for SAVE.

Is student loan forgiveness the same as the SAVE Plan?

Loan forgiveness is not granted immediately by SAVE. There is a new repayment plan that may result in a monthly payment reduction for borrowers. In contrast to 20 or 25 years, SAVE will discharge loans in as little as 10 years, allowing eligible borrowers to qualify for loan forgiveness sooner.

How does a save plan work?

Also known as The SAVE Repayment Plan, this adjusts individual’s monthly payments to a percentage of your discretionary income. Discretionary income is the difference between your annual income and a percentage of the U.S. Department of Health and Human Services poverty guideline for your state and family size.

Does interest accrue on save plan $0 payment?

Yes! The plan also subsidizes any unpaid interest that remains after a borrower makes a payment—meaning that balances will not increase over time. These $0 payments is what counts toward eventual forgiveness.

How will I know if my student loans are forgiven?

Through your email or other forms of contact you provided, your student loan servicer(s) will notify you directly after your forgiveness is processed. Just ensure to keep your contact information up to date on StudentAid.gov and with your servicer(s). If you haven’t yet qualified for forgiveness, you’ll be able to see your exact payment counts in the future.

What is the difference between Save Plan and PAYE plan?

It is simple: The PAYE plan offers a typical repayment term of 20 years, while SAVE plans are 20 years for undergraduate loans and 25 years for graduate loans.

How do I know if I am on the save plan?

To verify your status and view your loan(s) and your loan type(s), log in to StudentAid.gov and go to your My Aid page. Your loans will tell you which repayment plan you are enrolled in.

Does the save plan forgive loans?

Yes! All borrowers on SAVE receive forgiveness after 20 or 25 years, depending on whether they have loans for graduate school. The benefit is based upon the original principal balance of all Federal loans borrowed as a student to attend school, not what a borrower currently owes or the amount of an individual loan.

Why is my save repayment so high?

The reason is; your monthly payment on the SAVE plan is income-driven, whereas your monthly payment on the standard repayment plan is balance-driven. Therefore, if your loan balance is high and your income is high your payments may be higher on the SAVE plan.

Do I pay interest on the save plan?

No! The Department of Education will stop charging any monthly interest not covered by the borrower’s payment on the SAVE plan. As a result, borrowers who pay what they owe on this plan will no longer see their loans grow due to unpaid interest.

Which is better, SAVE or PAYE?

This is entirely dependent on your situation. Whether PAYE or SAVE is better for you will depend on your situation. SAVE may offer more affordable payments for low-income borrowers, while PAYE may be better for borrowers with graduate loans, as it offers a shorter repayment term. Use Federal Student Aid’s loan simulator tool to compare your options.