The 6 BEST High Yield Savings Accounts Of 2024

Selecting the ideal savings account is crucial in the present financial environment if you want to maximise your returns on investment. The growing popularity of high-yield savings accounts (HYSA) can be attributed to their much higher interest rates as compared to standard savings accounts. With respect to the rate of return, features, and flexibility, the top six high-yield savings accounts for 2024 are reviewed below.

The high-yield savings account from American Express

In addition to having an alluring 4.25% annualised return on investment (APY), the American Express High-Yield Savings Account is FDIC insured up to $250,000. It is a practical choice for those looking for a hassle-free savings experience because it has no monthly fees and no requirements for a minimum balance.

If you prefer a savings account with seamless access to your funds and enjoy excellent customer service, the American Express High-Yield Savings Account is a solid choice.

UFB Direct Savings Account

With one of the highest APYs available, 5.25%, the UFB Direct Savings Account stands out for individuals seeking the greatest interest rate possible. It has no minimum balance restrictions, no monthly fees, and is FDIC insured up to $250,000.

The ability of UFB Direct to raise your APY to 5.45% by completing a straightforward four-step method sets it apart from the competition:

- Create a UFB Freedom Checking Account to start earning an additional 0.20% APY.

- Establish Direct Deposits: An additional 0.05% will be added to your APY for each $5,000 in direct deposits made each month.

- Hold a $10,000 Balance: You will receive an extra 0.10% APY if you maintain a $10,000 minimum balance.

- Complete Debit Transactions: Making at least 10 debit transactions per statement cycle will add the final 0.15%.

These steps may require effort, but even without them, the base 5.25% APY is already quite competitive. If maximizing your interest is your main goal, UFB Direct is an excellent choice, especially when compared to larger banks like Chase or Bank of America, where interest rates may be as low as 0.01%. The difference between earning $1 at a 0.01% rate versus $545 at a 5.45% rate on a $10,000 deposit is substantial and illustrates the power of high-yield accounts.

Marcus by Goldman Sachs

With an annual percentage yield (APY) of 4.40%, Goldman Sachs, one of the biggest investment banks in the US, provides the Marcus High-Yield Savings Account. It has no monthly fees or minimum balance requirements and is FDIC-insured up to $250,000, just like the other accounts discussed here.

Marcus offers same-day transfers up to $100,000, which makes it possible for you to start collecting money right away. This is a unique service. This is especially helpful if you wish to transfer big amounts of money between accounts quickly or if you require quick access to your funds. Marcus offers a quick transfer function and a good reputation, which more than make up for the account’s lower interest rate when compared to other accounts on our list.

For those who prioritize immediate access to funds and value convenience, Marcus is an excellent option.

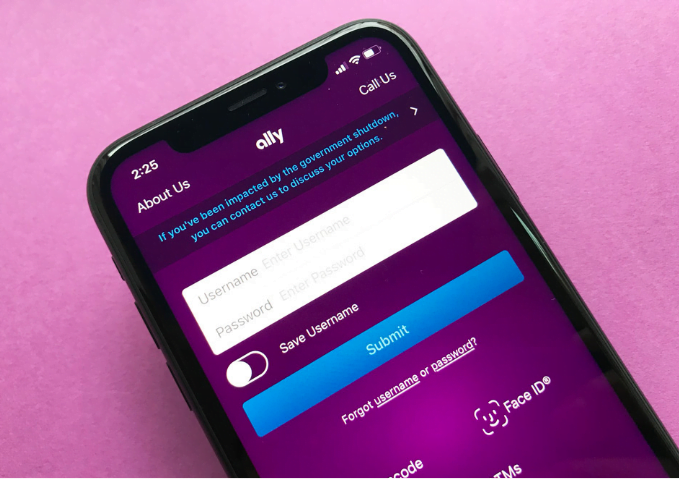

Ally Bank High-Yield Savings Account

FDIC-insured up to $250,000, the Ally Bank High-Yield Savings Account has an APY of 4.20%. Ally Bank offers a number of helpful services to help you manage your money more effectively, making up for its lower interest rate.

The Savings Buckets offered by Ally Bank are one of its best attributes. This enables you to allocate your savings to various “buckets” for particular purposes, such a wedding, vacation, or emergency fund. If you have $10,000 saved, for instance, you can set aside $5,000 for an emergency fund, $3,000 for a trip, and $2,000 for discretionary spending. You might feel more in control of accomplishing your savings objectives with this organisation.

Another feature that makes saving money easy is Round-Ups.When you pair your Ally savings account with an Ally spending account, the bank rounds up every purchase made with your debit card to the nearest dollar, and the difference is automatically transferred to your savings. This is a simple way to save small amounts consistently.

Finally, Surprise Savings is a unique feature that automatically analyzes your spending patterns and income to move small amounts of money from your checking account to your savings. These amounts are usually under $100 and are transferred no more than three times a week.

If you’re looking for an account with innovative tools to help you save, Ally Bank’s High-Yield Savings Account is worth considering.

SoFi Checking and Savings Account

The SoFi Checking and Savings Account combines both accounts into one product, offering a 4.60% APY on the savings portion and a 5% APY on the checking account. SoFi is FDIC-insured up to $2 million, which is significantly higher than the $250,000 FDIC insurance limit offered by most other banks.

SoFi is also offering a $300 sign-up bonus if you set up direct deposits and meet certain conditions. To qualify, you need to set up direct deposits from a payroll, benefits provider, or government agency. PayPal or Venmo transfers do not qualify. Depending on the amount of your direct deposits, you can earn either a $50 or $300 bonus.

Additional features include the ability to get paid up to two days earlier when you set up direct deposit, and Vaults, which function similarly to Ally Bank’s savings buckets. You can also earn up to 15% cashback on select purchases made with your SoFi debit card.

If you’re looking for a combination of checking and savings accounts with flexible features, SoFi is a compelling option, particularly if you qualify for the $300 sign-up bonus.

Laurel Road High-Yield Savings Account

The Laurel Road High-Yield Savings Account offers a 5.15% APY and is FDIC-insured up to $250,000. There are no monthly deposit requirements or fees, making this account straightforward and easy to use.

While Laurel Road does not offer many extra features, its simplicity and high interest rate make it appealing. It also provides student loan forgiveness consultations and refinancing options, which can be beneficial if you’re managing student loans.

For those interested in a no-frills savings account with a high APY, Laurel Road is an excellent option.

Summary

When compared to regular accounts, high-yield savings accounts are a great way to increase the interest you receive on your investments. A few accounts stand out in 2024 due to their flexibility, special features, and high interest rates. Among them are:

- The American Express High-Yield Savings Account has no fees, 4.25% APY, and round-the-clock customer service.

- UFB Direct Savings Account: Provides a starting annual percentage rate (APY) of 5.25%, with the possibility to grow to 5.45% APY by completing four steps.

- Marcus by Goldman Sachs – Provides a 4.40% APY and same-day transfers for up to $100,000.

- Ally Bank High-Yield Savings Account – Offers 4.20% APY with useful tools like Savings Buckets, Round-Ups, and Surprise Savings.

- SoFi Checking and Savings Account – Offers 4.60% APY on savings, 5% APY on checking, and up to $2 million in FDIC insurance, along with a $300 sign-up bonus.

- Laurel Road High-Yield Savings Account – Offers a straightforward 5.15% APY with no monthly fees or deposit requirements.

These accounts offer various features such as customer support, additional savings tools, and even sign-up bonuses. Depending on your financial needs, whether it’s maximizing interest or organizing your savings, one of these accounts may be the right fit for you.

Other Commonly Asked FAQs

- What is a high-yield savings account? A high-yield savings account is a type of savings account that offers much higher interest rates than traditional savings accounts, allowing you to earn more on your deposited funds.

- Are high-yield savings accounts safe? Yes, as long as the account is FDIC-insured (up to $250,000), your money is safe in a high-yield savings account, just like it is in a traditional bank account.

- Do high-yield savings accounts have fees? Most high-yield savings accounts do not have monthly fees or minimum balance requirements, though this can vary depending on the bank. Be sure to check the account details for any hidden fees.

- How do I maximize the APY on my savings account? To maximize your APY, follow the specific steps outlined by the bank, such as maintaining a certain balance, setting up direct deposits, or making debit transactions.

- Can I access my money easily in a high-yield savings account? Most high-yield savings accounts allow easy access to your funds. Some accounts even offer same-day transfers, while others may take a few days to process withdrawals.

- What’s the difference between a traditional savings account and a high-yield savings account? The key difference is the interest rate. High-yield savings accounts offer significantly higher APYs, which means your money grows faster compared to traditional savings accounts.

- Do I pay taxes on the interest earned from a high-yield savings account? Yes, the interest earned from any savings account is considered taxable income and must be reported on your tax return.

- Are online-only banks offering high-yield savings accounts reliable? Yes, many online-only banks are FDIC-insured and offer excellent rates due to lower overhead costs. They are just as secure as traditional brick-and-mortar banks.

- How often do the interest rates change? Interest rates on high-yield savings accounts can fluctuate depending on market conditions and the Federal Reserve’s rates. Banks adjust their APYs in response to these changes.

- Can I open multiple high-yield savings accounts? Yes, you can open multiple accounts at different institutions, which can help you diversify your savings or take advantage of specific features offered by each account.