7 Best Credit Card Sign Up Bonuses RIGHT NOW | Best Ever Offers:120K Points, 5 Free Nights

Today we’re looking at some of the best intro bonuses available right now. Whether you’re looking for cash back, economic travel, an aspirational trip, or something that could work for all three, there’s a ton of options.

Capital One Venture Card

First up, we have the Capital One Venture. Reminder that you can get this even if you already have the Venture X. For the Venture, you’re getting 75,000 bonus miles after $4,000 in purchases in the first 3 months. On top of this, you get a one-time $250 Capital One Travel credit that’s valid for one year when you open up the account. Even though that is separate, I would probably only sign up if you could finish the minimum spend. The minimum value for travel is $250 for the Capital One Travel credit and 75,000 miles, which is $750 in travel—making it $1,000 total in travel.

The miles can be worth more if you want to transfer out to partners and if you care about that type of travel. The $1,000 minimum travel value divided by the $4,000 minimum spend is a 25% return on spend. Anything above 20% is usually good in my book. There is a $95 annual fee, but $1,000 – $95 means you’re netting $905 in value in the first year. In year two, you can reevaluate, but year one makes a ton of sense.

Capital One Venture X Card

Next up is the older brother, the Capital One Venture X. Technically this one isn’t elevated, but it’s still a great card. You get 75,000 miles after $4,000 in purchases in the first 3 months. Also, note that there isn’t a one-Venture rule, so even if you have the Venture, you can still get the Venture X.

The minimum travel value for the 75,000 miles is $750, which divided by the $4,000 spend is an 18.75% return on spend. The main draw of the card is that it’s a good keeper card, even though it does have a $395 annual fee. You get a $300 Capital One Travel credit and 10,000 anniversary miles every cardmember anniversary. The minimum value of the 10,000 miles is $100 toward travel. Long-term, you’re getting $400 in travel value every year for a $395 annual fee.

If you don’t travel, none of this makes sense, but for most people, even if you take just one trip a year, you’re probably good. This is before considering Capital One lounges, partner lounges like Plaza Premium and Priority Pass, and the superpower of the card: you can add up to four authorized users for no additional fee. They also get access to these lounges and their own Priority Pass card. If I had to recommend one travel card for a person, especially someone new to the space who doesn’t want something overly complicated, it would probably be this one.

American Express Gold Card

Next, we have the American Express Gold Card. It has a $325 annual fee but also a lot of credits. This includes new ones like Dunkin’s and Resy, alongside the old dining credit with new partners, and Uber Cash, which hasn’t changed. Long-term, it depends on how much you value the credits and how much you spend. In year one, though, it’s the intro bonus that matters. The base offer is 60,000 points after $6,000 spend in the first 6 months. There’s also a 20% back component for dining worldwide for 6 months, up to $100 back, ending November 6, 2024.

While this is fine, many people have been able to get better offers, like 90K plus with the same statement credit for the dining component. This is through Card Match. It’s targeted, so it can be hit or miss, but many people are getting targeted. We have a blog post on this, and it should pop up if you Google “Card Match Ask Sebby.” I’ll also link it down below.

American Express Platinum Card

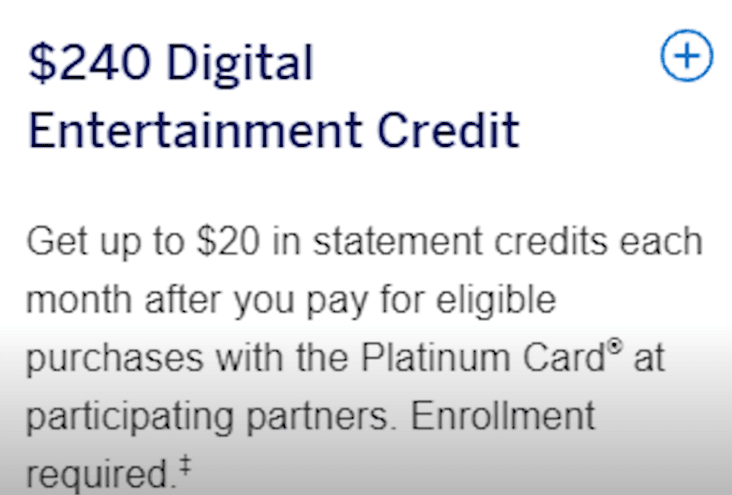

The American Express Platinum Card is similar with a $695 annual fee, but it also comes with a lot of credits. If you’re new to the card, be cautious of the marketing claims of $1,500 in value. While the credits are there, you need to figure out which ones you’re actually going to use and which ones you should discount. For most people, there are a few tangible ones to help you break even or go beyond it. One is the Digital Entertainment Credit. Another, especially if you live in a city, is Uber Cash.

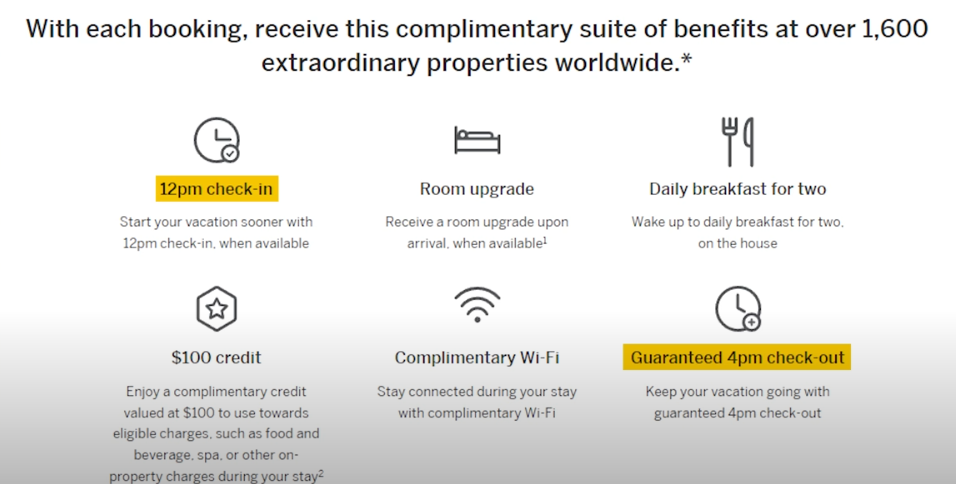

The Airline Fee Credit is a bit more of a challenge, while the Saks Fifth Avenue credit is useful if you enjoy shopping. The hotel credit is pretty nice if you stay at FHR (Fine Hotels and Resorts) or within The Hotel Collection. For example, we used three of our credits on a recent Hawaii trip. One night was booked at the Kalaii Resort through FHR. The next night, we switched to Mandy’s room at the same hotel, then spent two nights at Prince, part of The Hotel Collection.

Even before the hotel credit, we would hop from one FHR property to another because of the guaranteed 4 p.m. late checkout and generally early check-in. It depends on how you travel and whether you value Centurion lounges, but for us, it made sense for both Mandy and me to have our own Platinum cards.

JetBlue Plus Card by Barclays

Heading over to Barclays, we have the JetBlue Plus Card. The offer here is great for lower spenders, offering 80,000 bonus points after $1,000 in purchases in the first 90 days. The value of JetBlue points can vary, but generally, you’re looking at 1.2 to 1.3 cents per point, or higher. This means that on the low end, you’re getting about $960 to $1,040 in value for $1,000 spend, pretty much a 100% return on spend and well worth the $99 annual fee.

For our Hawaii trip, we booked two people from Honolulu to Phoenix. It cost 120,000 JetBlue points and $11.20 in fees. The list price for those two flights was $3,000, and we would have paid $1,800 (or $900 per person). This means the rack rate per point is about 2.5, and the actual rate we paid was about 1.5. For me, the question is whether the points meet or exceed my target, and do I want to take the trip? We ended up using JetBlue to book the partner Hawaiian Airlines to try their new business class in the 787 Dreamliner.

IHG Premier Card by Chase

Heading over to Chase, we have the IHG Premier Card. This offer is great, but you need to be careful. It’s the best offer ever, with five free nights, each worth up to 60,000 points, for a total of 300,000 points. This comes after $4,000 spend in the first 3 months. The main issue is that each night is worth a fixed value (up to 60K points), and you can’t use additional points to top off if the cost exceeds 60K.

There is value here, but you should run the numbers. For example, if you want to go to Singapore, hotel prices vary. You might find a hotel under 60K points, but if it’s more, you’re out of luck. The last thing I’d want is for you to get a card with a bunch of nights that you can’t use. We did a deeper dive into this in last month’s intro bonus video, so it might be worth checking out.

Chase Ink Preferred Card

Lastly, we have the Chase Ink Preferred. This is a historic high offer, though we don’t know when it will end. You get 120,000 bonus points after $8,000 in purchases in the first 3 months. If you redeem them as statement credit or transfer to your Chase checking account, that’s $1,200 cash back. There’s even more value if you travel, especially with Hyatt stays or aspirational trips. We used 35K points per night at a hotel with a $1,500 rack rate.

In summary, $95 annual fee makes sense for year one, and if it doesn’t work for you in year two, you can downgrade. If you do anything on the side—personal training, website design, photography—you probably qualify for business cards as a sole proprietor.

Conclusion

If you want to learn more about these cards, we have links on the website and down below in the description box. If you made it this far, leave a dolphin emoji in the comments, and I’ll try to heart it and respond. Seeing baby dolphins was the best part of our Hawaii trip.

FAQs: 7 Best Credit Card Sign Up Bonuses RIGHT NOW

1. What is a sign-up bonus for a credit card?

A sign-up bonus is a special offer made by credit card providers to prospective customers. You can accrue rewards like points, miles, or cash back after fulfilling a predetermined minimum spending criteria during a predetermined time frame, usually three to six months.

2. How can I get a bonus when I sign up?

In order to be eligible, you often have to have a new card and spend a minimum amount within a predetermined window of time (for example, $4,000 in the first three months). Other eligibility limitations, such as credit score requirements, might apply to some cards.

3. What’s the difference between the Capital One Venture and Venture X cards?

The Capital One Venture offers 75,000 miles after $4,000 in purchases and a $250 travel credit, while the Venture X offers the same miles with additional benefits such as a $300 travel credit, 10,000 anniversary miles, and no fees for authorized users, though it has a higher annual fee ($395 vs. $95).

4. Is the American Express Gold Card worth its $325 annual fee?

The American Express Gold Card comes with valuable credits (like dining and Uber Cash) that can offset the $325 annual fee. The value largely depends on whether you’ll use those credits and how much you spend on dining, groceries, and travel.

5. How can I get better offers for the American Express Gold or Platinum Cards?

You may be able to access better offers through targeted promotions such as Card Match, where some users can receive offers like 90,000 or 150,000 points, respectively, for these cards. These are targeted, so your results may vary.