E-Transfer Payday Loans Canada 24/7

Canada’s 24/7 Payday Loans

We are aware that you value receiving your money quickly. So, we will be sharing with you platforms that use Interac e-Transfer to issue their loans because of this. That implies that we will only share with you, platforms that allows you receive your money immediately. Considering that EFT loans only come in the next business day, the platforms we are to share is a far better option than what other lenders offer. In most platform, you cannot receive any money until Monday if your application is submitted after Friday. When a payday loan takes three days to process, what good is it?

Additionally, the majority of lenders only process loans during regular business hours. If you are unable to check your email in a timely manner, it could pose a serious issue. For example, you can take an online payday loan with My Canada Payday whenever it’s convenient for you, day or night, as soon as the contract arrives in your inbox.

They’re open around-the-clock, unlike other lenders. They will transfer the money to you in a couple of minutes, regardless of when you accept the deal. You won’t experience any issues if your bank accepts Interac e-Transfer, which is the case for almost all Canadian banks. Getting your money to you when it’s convenient for you, not the other way around, is their first focus.

How is the procedure carried out?

They will send you an email with a link as soon as you complete the application and submit your financial information via our secure banking data provider. After you click the link, a page with the contract outlining the terms of the loan, an electronic signature section, and any conditions you must accept will appear.

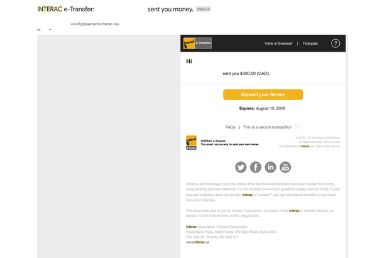

Your email address that you supplied throughout the application process will automatically receive an e-Transfer from their systems as soon as you complete the digital signature and submit the form. This is how the email ought to appear:

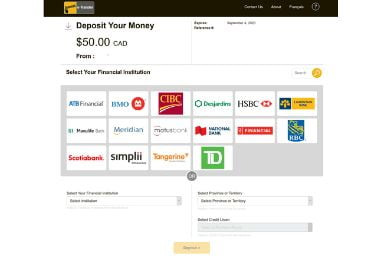

Once you click the link in the email, you’ll see this screen:

After selecting your bank, you’ll be asked to input your login information for online banking. The money will instantly be in your account and usable as soon as you’ve completed that. No holds, no issues!

What prerequisites must be met?

There are requirements that a borrower must meet for every loan. My Canada Payday makes it simple to be eligible for a loan.

Age

Nineteen is the minimum age required to be eligible for a loan from them .Every province in which they conduct business has the same situation.

Internet-based Banking

They will evaluate your internet banking history before granting you a loan. This aids in the verification of your income and guarantees that there are no major issues with your banking, such as numerous NSF payments.

Revenue

To be eligible for a loan, a person must make at least $1,000 each month. It is important to note that this revenue is not solely derived from employment; it can originate from a variety of sources. Specifically:

Pension, the pension income is deducted from the required minimum income. This covers both the Canada Pension Plan (CPP) and employer-sponsored pension plans.

Child Tax

You can apply for a child tax loan with My Canada Payday, even though the CCB payment is normally less than $1000 as long as your total income from all sources is above the cutoff.

Give credit

To obtain a loan from many lenders, a severe credit check is necessary. When working with My Payday Canada, they typically simply need to review your past online banking activity in order to reach a judgment. This entails no credit check, which is advantageous for both maintaining a high credit score and increasing your chances of approval.

Where do They conduct business?

My Canada Payday provide loans to residents of any of the following provinces:

- British Columbia Payday Loans

- Payday Loans in Alberta

- Payday Loans Manitoba

- Payday Loans Saskatchewan

- Ontario Payday Loans

- Cash Advances in Nova Scotia

You will require a reliable source of income. A regular paying employment, disability payments, pensions, child tax credits, or even CERB could be examples of that. Furthermore, you must be 19 years of age or older. Since there is no credit check, bad credit is not an issue. To apply, though, you will need to submit your online banking credentials. Since the application procedure is conducted fully online, there are no documents to fax over either.

Is Interac e-Transfer supported by all banks?

If a bank offers e-Transfers, as most do, they will also be available around-the-clock. However, a tiny percentage of banks—mostly credit unions—continue to refuse to accept Interac. However, getting an electronic transfer will be easy if you are at one of the “big 5” banks.

How E-Transfer Loans Canada Makes Funds Easily Accessible

Customers in Canada can obtain instantaneous loans using e-transfer loans. This is a pretty simple and quick process. The process of borrowing money only takes a few minutes. It would only be a modest sum, but it’s vital to keep in mind that it’s being borrowed online and needs to be safe.

The amount may be increased for the subsequent transfer if it is promptly reimbursed. Money can be easily accessed online with e-transfer. Payday loans come up in conversation as a true buddy helps indeed. Regardless of whether you want it in cash or an account, it gives a desirable efficiency. It is particularly convenient to transfer money online in the modern, digital world.

Online Verification

When submitting an application for an E-Transfer Loans Canada, you must provide the lenders with all the information requested. Until the company does not verify your authentication, you will not be able to acquire the loan. When you apply online, a page with certain instructions is redirected to you. All required information must be included into the form.

Completing the tab for the borrowed amount is also required. The amount of money you wish to borrow must be entered. The loan cannot surpass the amount of your paycheck because it is always made in little installments. Lenders would rather supply half of the monthly income.

Rapid Transfer of Loans

You will be transferring the money quickly after confirming the borrowers’ data. Approvers allow you to apply online. The first step in the online application process is to visit the company’s website and complete the application. To move on to the next step, you must adhere to the guidelines provided on the website. The characteristics of your account and the transactions you’ve done with it determine how much money you can move.

Money for Your Comfort House

You could need money delivered to your home during those pandemic days or now that most people work from home and barely leave the house. Money transfers are incredibly simple in today’s digital age. Your income sources and bank account information are the primary factors influencing how quickly you receive funds when you apply for an E-Transfer Loan from Canada. Once your bank has been verified, the next step of the process begins.

While some lenders approve the loan request right away, others require some time to review the borrower’s details before moving forward with the process. Therefore, if your loan is granted, a light credit check is frequently performed to make sure you can afford to accept the money. It takes several minutes for the money to be digitally sent into your account after approval. You can only borrow money for this online if you are a citizen of Canada.

Frequently Asked Questions

Are payday loans available on the weekends?

Yes, most payday loan company do grant loans on a daily basis. They’re always there to accept your application and quickly provide you with the money you require.

When can I come pick up my loan at night?

Yes, most payday loan company have a round-the-clock online loan acceptance mechanism.

Is a poor credit history acceptable?

It won’t be an issue if you have terrible credit because most payday loan company don’t run credit checks.

Do you run credit reports?

For most payday loans, a credit check is not required.

As long as you meet other requirements, you will receive your requested funds.

e-transfer payday loans Canada 24/7 child tax

The Child Tax Benefit, often referred to as the Canada Child Benefit (CCB), is a crucial government initiative designed to provide financial support to families across Canada. It plays a pivotal role in assisting parents with the financial responsibilities of raising children.

The following companies offer e-transfer payday loans Canada 24/7 child tax;

same day payday loans canada

The following companies offer same day payday loans in Canada;