How to Achieve Financial Independence with the 4% Rule

Financial independence often sounds like a distant dream, doesn’t it? I know it did for me. Years ago, I was stuck in a small apartment, drowning in bills. Not only that, we had an older couple living downstairs who smoked all day, and the smoke would drift into our place, making our clothes and furniture smell like cigarettes. On top of the overwhelming bills, we had a bug problem too. I remember thinking, “There’s got to be more to life than this.” Do you feel me on that? Well, guess what? There actually is, and I’m excited to share it with you. I discovered something called the Financial Independence Movement, also known as FI. These are the things we wish we had learned in high school, but instead, we were taught algebra.

What is Financial Independence (FI)?

First, let me break down what financial independence really means. It’s not just about having piles of cash and living in luxury. No, it’s about having control—control over your life, your choices, and your future. Imagine having the ability to decide whether or not you even want to work anymore. Some people retire as early as their 30s, 40s, or 50s, living life on their own terms. Others may love their jobs but want to have enough money to take dream vacations, subscribe to their favorite channels, or even leave a financial legacy for their loved ones.

The Power of the 4% Rule

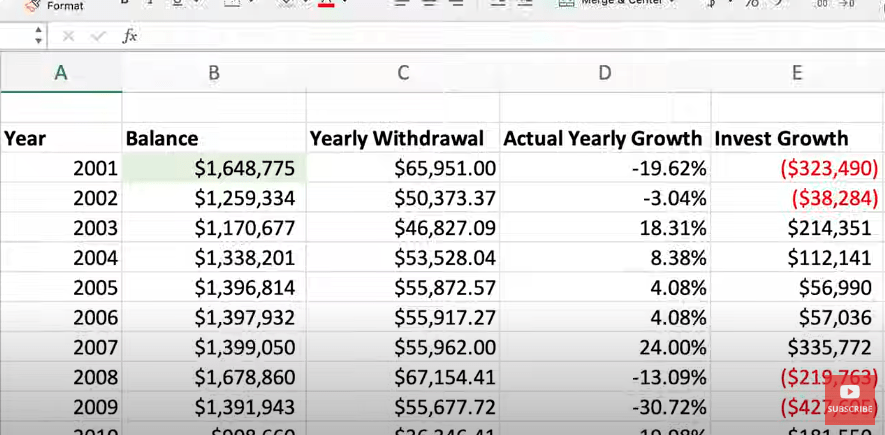

Let’s say over time, you’ve saved up enough to retire at age 40 with a decent investment portfolio. Why go back to 2001? Because I want to show you how a portfolio survives even when the stock market goes haywire, like it did in 2001, 2008, and during the COVID-19 pandemic in 2020. Suppose you’re living off of 4% of your portfolio, with no other income source. From 2001 to 2023, despite market crashes, your initial balance of $1.6 million grows to over $2.35 million—even while withdrawing 4% annually to live on. That’s the beauty of long-term investing.

You might wonder, “Why 4%? Why not more or less?” This comes from the Trinity Study, conducted by professors at Trinity University. They found that withdrawing 4% from your portfolio each year gives you a 95% chance of success over 30 years without running out of money. This even accounts for inflation. That’s the magic I wish I had learned in high school! If I had started at 18, I’d be so much further ahead now. But it’s okay—even if you’re starting later, the principles still apply. You can tailor Financial Independence to fit whatever lifestyle you want.

Tailoring FI to Your Lifestyle

FI is not about extreme frugality or minimalism (though it can be if that’s your thing). You can live lavishly if you want! The key is to customize your financial independence plan to your unique goals. There are four basic steps to achieving Financial Independence:

Step 1: Assess Your Finances

First, assess your current financial situation. Look at your income, expenses, and debts. Review the last 12 months of spending and calculate your average monthly expenses. For example, let’s say you spend $8,000 a month, including mortgage payments and other debts. That’s your starting point.

Step 2: Envision Your Future and Set Your FI Goals

Next, think about the future. What does your life look like 10, 20, or 30 years from now? When do you want to retire, and how much do you expect to spend in retirement? Will you be a minimalist, living frugally, or do you plan on taking luxurious cruises every month? Your future lifestyle will influence how much money you need to achieve FI.

There are three types of FI to consider:

- Lean FI: This is for minimalists who need very little to live on. They’ll likely reach financial independence faster because they don’t require a large portfolio.

- Normal FI: This is for people who plan to maintain their current standard of living in retirement.

- Fat FI: This is for those who plan to live large in retirement, traveling extensively, giving generously, and enjoying a more luxurious lifestyle.

Choose the one that fits your vision, and let that guide your financial planning.

Step 3: Apply the 25x Rule

Now that you’ve set your FI goals, it’s time to calculate your FI number using the 25x rule. This rule suggests that you need 25 times your annual expenses saved in investments to retire and withdraw 4% per year. For example, if you expect to spend $6,000 a month in retirement (or $72,000 a year), you would need to save 25 times that amount, which equals $1.8 million.

Don’t panic if that number seems huge. It may feel overwhelming at first, but it’s completely achievable over time, especially once you start saving and investing consistently.

Step 4: Start Building Your Portfolio

The final step is to start building your portfolio. Begin by investing as much as you can every month without sacrificing your current quality of life. For example, if you save $4,000 a month and invest it in a total stock market index fund, at a conservative 7% return, your portfolio could grow to over $2.3 million in 20 years—more than enough to reach your FI number.

Personally, I follow the investment principles from JL Collins’ book, The Simple Path to Wealth, which I highly recommend. The key is to invest regularly, stay the course, and let your portfolio grow over time.

Don’t Be Intimidated by Big Numbers

It’s easy to feel intimidated when you see numbers like $1.8 million or even more if you’re aiming for a fat FI lifestyle. But remember, you don’t have to achieve it overnight. Focus on what you can contribute now and increase your savings rate as you go. Many in the FI community get so excited about their progress that they start saving and investing even more over time. Personally, I started by saving just 10% of my income, but eventually increased it to 50% because I saw the power of compound growth.

Finding Balance: Enjoy Life Now and Later

One important point to remember is to enjoy life now while still planning for your future. FI isn’t about depriving yourself today so you can live later. It’s about finding balance—enjoying your current life while ensuring that your future is secure. For me, reaching FI has been a long journey, but I’m now just nine years away from complete financial independence, and I couldn’t be more excited.

The Joy of Control

Once you hit your FI number, you gain control over your life. You can decide whether you want to work, pursue a passion project, or simply enjoy your retirement. To me, there’s no greater feeling than having that level of control. It’s the ultimate freedom.

Conclusion: Start Your FI Journey Today

No matter where you are right now—whether you’re drowning in bills or already on your way to financial freedom—you can start your FI journey today. Follow the steps, start saving and investing, and watch your portfolio grow. The road to financial independence is within your reach. You can do it, and I’m here to tell you it’s worth every effort.

FAQs: How to Achieve Financial Independence with the 4% Rule

What is the Rule of 4%?

The annual amount that you can remove from your retirement savings without running out of money is estimated using the 4% Rule. According to this, you should have enough money to endure for 30 years in retirement if you take out 4% of your portfolio every year.

How does the Rule of 4% operate?

The 4% Rule determines a safe annual withdrawal amount of 4% of your overall retirement resources. If you have $1 million saved, for instance, you can take out $40,000 a year and change that amount to account for inflation every year.

Can the 4% Rule apply to early retirees?

Yes, the 4% Rule can apply to early retirees. Many people in the Financial Independence, Retire Early (FIRE) community use this rule to retire in their 30s, 40s, or 50s. However, because early retirees may have longer retirement periods, they may need to adjust for potential market fluctuations and a longer lifespan.

What kind of investments should I have for the 4% Rule to work?

The 4% Rule works best with a diversified portfolio, typically a mix of stocks and bonds. Many experts suggest a portfolio with around 60-75% in stocks and the rest in bonds to balance growth and risk.

What occurs if I retire and the market collapses? Is the 4% Rule still applicable?

Tests of the 4% Rule have been conducted using historical market data, which includes downturns such as the COVID-19 pandemic, the 2008 financial crisis, and the dot-com bubble.Although your portfolio may be impacted by market crashes, a well-diversified portfolio should eventually recover. To protect their money, some people decide to limit their withdrawals during market downturns.