Ultimate Guide to Retirement Planning in 2024

Retirement Planning Guide in 2024 Optimize your strategy with CPP timing, RSP meltdown, and laddered income for a secure future.

I’m going to do a full plan build here, breaking it into snippets. Obviously, a full plan build takes many hours to complete, but I want to highlight the key points so that when you meet with your financial planner, you make sure these same points are built into your plan. There are things you might not be thinking about and different ways to look at them. So, let’s jump into the software and see how this works.

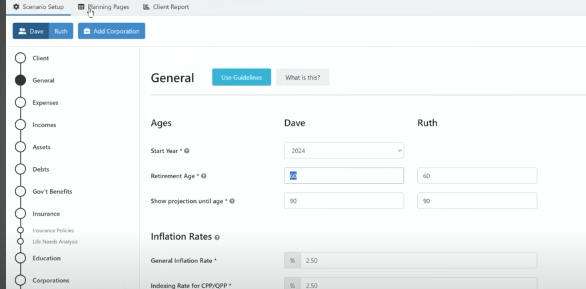

Choosing the Right Software for Detailed Planning

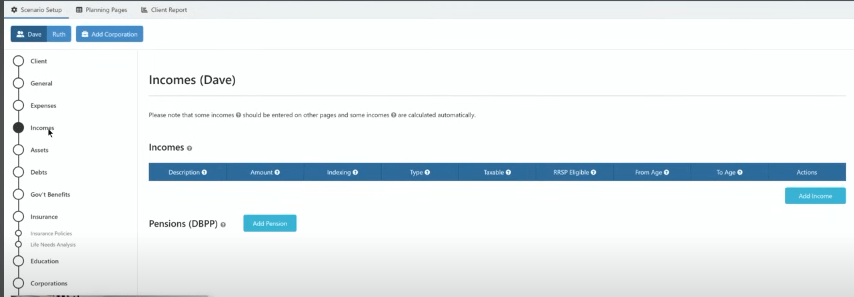

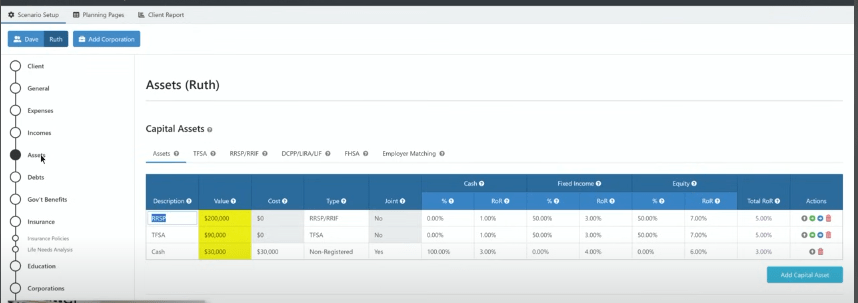

Depending on what type of software your planner is using, we use Snap Projections. We like it because it gives us a detailed view, almost down to a 5-foot level. You’ll see along the left-hand side here, we have your general information, any additional expenses you want to have in there, and any incomes you have. If you’re still working, plug those into the software so you can see how much extra money you have. For Dave and Ruth, we have Ruth with a pension, so we put her defined benefit pension plan in here.

Make sure all your assets are included in the plan. It’s surprising how many plans we review where assets are missing, like an RSP at work worth $100,000 that the previous planner forgot to include.

Accounting for Debts and Government Benefits

You should also ensure that any debts and government benefits are accounted for. We’ll go through this further in the video, but you want to figure out what you’re going to get at 65, what percentage or dollar amount you’ll receive, and then work with those numbers.

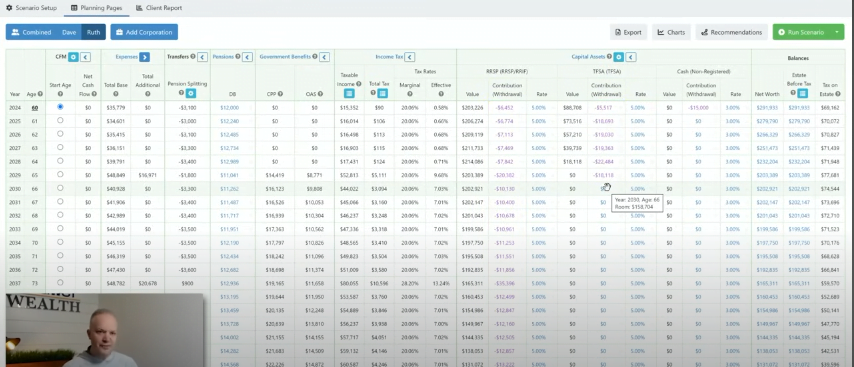

When we look at the overall summary, you’ll see a lot on the screen, but the key parts are your expenses. If I go to a combined view of both Dave and Ruth, we can see the real expense.

This shows how much after-tax, in-pocket dollars they’re going to have. This is what we call our base plan or default plan. It’s basically a data dump into the software; we hit generate and see our starting point.

Analyzing Income and Expenses: A Base Plan Overview

For Dave and Ruth, with the assets they have, Ruth’s small pension, CPP, and old age security, they have a very nice income. They’re retiring at 60, and we have this mapped out to age 90. Another key part is to make sure you understand the rate of return, the inflation rate, and life expectancy, as all these factors matter in a plan. Make sure you talk to your planner to understand what they’re using, and make sure it maps out properly for what you want to see. They’re starting with $7,816. One of the issues here is the total tax bill. We’re looking at $238,000 in total tax on $7,816, which is after-tax, adjusted for inflation.

Nominal and Inflation-Adjusted Values

The nominal dollar amount is the actual amount you will have in your pocket that year. For instance, if we fast forward ten years to 2034, you’ll see they’ll have $9,600 in their pocket for spending, equivalent to $7,816 in today’s dollars. If I jump into each one individually, we’re taking out the minimum out of the RIF every year.

As they get into their 80s, they still have over $100,000 in Dave’s RIF account, while their TFSA and non-registered cash are wiped out right away. We haven’t considered CPP and OAS timing yet. Ruth’s minimum RIF amount is also being withdrawn, and her TFSA is gone by mid-60s, which is not a great plan and offers little flexibility.

Starting with the Base Plan and Identifying Improvements

This is where we need to improve. So, start with your base plan. What’s the starting point? What are we working with from square one? Once we have the default, the first thing to consider is CPP timing.

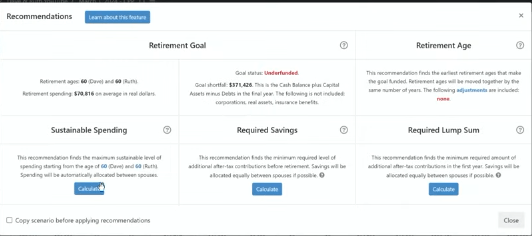

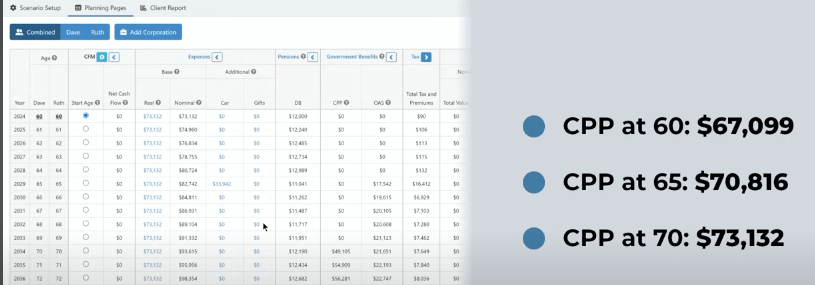

When does it make the most sense to take both CPP and old age security? CPP will have a bigger impact, so let’s look at that. For Dave and Ruth, taking their CPP at 60, 65, and 70 shows different outcomes. At age 65, which was the default, they have $595 left at age 90. They’re able to spend $7,816 annually.

Exploring the Impact of Early CPP Withdrawal

What happens if we change CPP to age 60 and take it right away? We’ll change Dave and Ruth’s CPP to start at 60. Now, they have CPP starting at age 60, and we can run a new plan. Based on taking CPP earlier, their after-tax, adjusted for inflation income drops by $3,717 per year.

That’s a massive difference and a penalty for taking their Canadian Pension Plan early. Instead of $70,000 a year for the next 30 years, they have only $67,000. That’s still a great income, but they’re leaving over six figures on the table by taking their CPP early.

The Benefits of Delaying CPP to Age 70

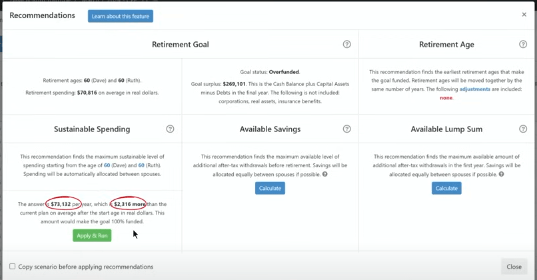

What happens if we delay it? We’ve bumped CPP to age 70 for both. So, instead of taking less at age 60, we’re taking it at 70. Now, their after-tax income increases by $2,316, adjusted for inflation.

That’s a significant benefit. The difference between taking CPP at age 60 versus 70 could mean a near $400,000 difference in lost income if they live to age 90. I would recommend taking it at 70, but again, everyone’s situation is different, so go through this process with your planner.

Tax Rate Considerations and Income Maximization

One thing we always consider in planning is the tax rate. You can see they’re paying more tax, about $268,000, but the first step is maximizing the after-tax income. If you’re collecting more after-tax income, even if you’re paying a bit more tax, it’s a net benefit.

Now, we’ve looked at CPP timing but haven’t considered RSP meltdown or tax planning. The problem with this approach is their effective tax rate is 0% for the first five years of retirement. Their taxable income is below the personal exemption, meaning they’re paying no tax.

Addressing the Roller Coaster Tax Effect

That’s an issue because they’ll experience a roller coaster effect – low tax rates, then high, then back down. We want to level that out as best as possible. We also want to extend the lifespan of their TFSA to create more flexibility. The target is to have their RSP wound down better, so they don’t face a big tax bill later in life. Currently, their after-tax spending is $73,320 by delaying their CPP to 70, without any proper tax planning or RSP meltdown strategy.

Implementing the RSP Meltdown Strategy

Now, let’s look at the RSP meltdown. I’ve played with the numbers and found the sweet spot. For Dave, he has a substantial RSP to draw down. Even though CPP doesn’t start for 10 years, the income comes from other sources. Delaying CPP gives you more money long-term. You can wind down your accounts quicker. Some people worry about spending their money because if they die early, it won’t pass on. You have to use the data, life expectancy, and rate of return to guide these decisions.

Winding Down RSP Accounts Strategically

We’ve wound down about $24,000, then later about $15,000 annually. Once CPP starts, we’re winding down by about $155,000, and Dave’s RSP is emptied out by 84.

Our typical target is mid-80s for life expectancy. A side benefit is that Dave still has a TFSA account through retirement. He’s spending a bit of it, but it’s not wiped out in the first four to five years. Ruth’s RSP winds down quicker, and she’s done by age 69, so her RIF is drawn out by then, and she holds on to her TFSA.

Leveling Out the Tax Rate for Consistency

Focus on the effective tax rate or average tax rate in your plan. For Ruth, it stays around 7% to 7.5% through retirement. That’s what we want, a level tax rate. The average tax rate is more impactful than the marginal tax rate. For Dave, his average tax rate is also around 7% to 7.5%. Not only are their tax rates level, but they’re also similar to each other. Income splitting throughout the years helps level the tax bill.

Creating Flexibility and Accounting for Additional Expenses

When we do this, their income jumps a few hundred every year. It’s not substantial, but it allows them to melt down their RSP better, keeping the TFSA longer, creating flexibility for emergencies. We’ve included additional expenses like a vehicle purchase every 7 to 8 years through retirement. Their total tax doesn’t spike in those years because we’re using the TFSA. Without the TFSA, taxes would jump significantly, so plan for these expenses and level out your tax rate.

Impact of Delaying CPP on Taxes and Income

With CPP timing bumped to 70, it increased their total tax but also increased their after-tax income. The taxes went up, but their pocketed income did too. After implementing income strategies, their taxes dropped back below the default plan. You’ve put more money in your pocket and given less to CRA. These are key strategies: CPP timing, RSP meltdown, taxes, and level average tax rates.

Implementing a Laddered Income Strategy

What if they don’t need $73,000 a year? Typically, the next step is looking at a laddered income strategy. Everyone’s strategy will differ, but you want a “go-go” phase in early retirement when you’re healthier and can spend more. Then, a “slow-go” phase when spending naturally decreases. Finally, a “no-go” phase when spending is minimal. This is how your retirement plan should look.

Adjusting Income Levels for Different Retirement Phases

Here, instead of $73,000 level throughout retirement, we’ve structured it as $76,000 in the early years, $65,000 in the middle, and $60,000 in the later years. When we do this, the after-tax number drops by a few hundred, but they’ve spent more money when they’re younger. Their income levels drop as they get older, reflecting the natural curve of how we spend money.

Optimizing the Plan with Key Strategies

Their tax rate still levels out, around 7% to 7.5%. These three elements: CPP timing, RSP meltdown, and laddering strategy, help optimize the plan. Look at your own situation and discuss with your planner. What strategies will help optimize your situation? This is how you build an effective retirement plan.

Conclusion: Focusing on After-Tax Income

It’s not about how much you have but how much you keep. If you take more out of your plan than you keep, there’s no value in that. Focus on the after-tax income and level it out. Look at CPP timing, winding down RSP, and laddering income. These strategies are beneficial, but every situation is unique, so tailor them to your circumstances.

FAQ: Retirement Planning Strategies

1. Why is it important to include all assets in a retirement plan? Including all assets ensures that your financial planner has a complete picture of your financial situation. Missing assets, like an RSP or a pension, can lead to inaccurate projections and an inefficient retirement plan.

2. What should I consider when planning my retirement income? You should account for all potential income sources, such as pensions, government benefits, and investment returns. Additionally, consider the timing of withdrawals and the tax implications of different income streams.

3. How does delaying CPP affect my retirement income? Delaying CPP can significantly increase your retirement income over time. Although you may pay more in taxes, the after-tax income you receive is generally higher, resulting in a net benefit over the long term.

4. What is an RSP meltdown, and why should I consider it? An RSP meltdown strategy involves systematically drawing down your RSP to reduce the tax burden later in retirement. This approach helps avoid high tax rates in the future and provides a steady income stream early in retirement.

5. What is the “roller coaster” tax effect, and how can I avoid it? The roller coaster tax effect refers to fluctuating tax rates due to irregular income withdrawals. You can avoid it by leveling out your withdrawals and using strategies like income splitting and TFSA utilization to maintain a consistent tax rate.

6. How can I ensure my retirement plan is flexible enough to handle unexpected expenses? Including emergency funds and planning for future expenses like healthcare or significant purchases (e.g., a new vehicle) within your retirement plan helps maintain flexibility. Utilizing TFSAs can be beneficial for covering these unexpected costs without tax penalties.

7. What is a laddered income strategy, and why is it useful? A laddered income strategy adjusts your income according to different phases of retirement: “go-go” (active years), “slow-go” (reduced activity), and “no-go” (minimal spending). This helps optimize spending and ensures your savings last through retirement.

8. Should I be more concerned with my average tax rate or marginal tax rate? In retirement planning, the average tax rate is more critical because it reflects the overall percentage of income paid in taxes. A lower and more consistent average tax rate results in better long-term financial stability compared to focusing solely on the marginal tax rate.

9. How does the timing of taking CPP and OAS affect my financial plan? The timing of taking CPP and OAS can greatly impact your retirement income. Taking these benefits earlier can reduce your overall income, while delaying them can significantly increase it. It’s essential to find the optimal timing based on your life expectancy and financial needs.

10. What are the benefits of using a tool like Snap Projections for retirement planning? Snap Projections provides a detailed view of your financial situation, allowing for more precise planning. It helps visualize different scenarios, such as varying CPP withdrawal ages and RSP meltdown strategies, ensuring you make well-informed decisions.

11. What should I discuss with my financial planner before finalizing my retirement plan? Ensure all assets, income sources, debts, and expected expenses are included. Discuss strategies for CPP timing, RSP drawdown, tax planning, and potential changes in spending throughout retirement. Tailor the plan to your specific goals and needs for optimal results.

12. How often should I review and update my retirement plan? It’s recommended to review your plan annually or when there are significant changes in your financial situation, such as a new source of income, unexpected expenses, or changes in your retirement goals. Regular updates help keep your plan aligned with your current circumstances.